- Home

- Statistics

- Market Review

Market Review of Dessicated Coconut

October 2024

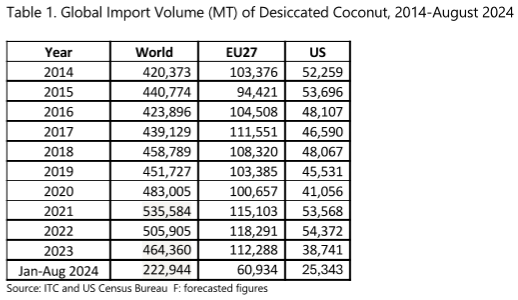

Global imports of desiccated coconut have undergone notable fluctuations over the past decade, reflecting shifting market dynamics and evolving consumer preferences. In 2014, global imports stood at 420,373 metric tons (MT) and surged to a peak of 535,584 MT in 2021, fueled by growing demand for natural and plant-based ingredients. However, this upward trajectory reversed, with imports declining to 464,360 MT in 2023 and continuing to weaken into early 2024.

The European Union (EU27) has demonstrated consistent growth, solidifying its position as a leading market for desiccated coconut. Imports increased steadily from 103,376 MT in 2014 to a peak of 118,291 MT in 2022. Despite a modest dip to 112,288 MT in 2023, the EU remains a reliable market, driven by consumer interest in sustainable and health-focused products.

Conversely, the United States has seen greater volatility. After peaking at 54,372 MT in 2022, imports plummeted to 38,741 MT in 2023, with January–August 2024 figures totaling just 25,343 MT, indicating persistent weak demand. This decline may stem from economic pressures, shifts in consumer preferences, or competition from alternative ingredients.

On a global scale, the post-2021 downturn in imports is likely influenced by economic slowdowns, supply chain disruptions, and climate-related challenges affecting coconut-producing countries.

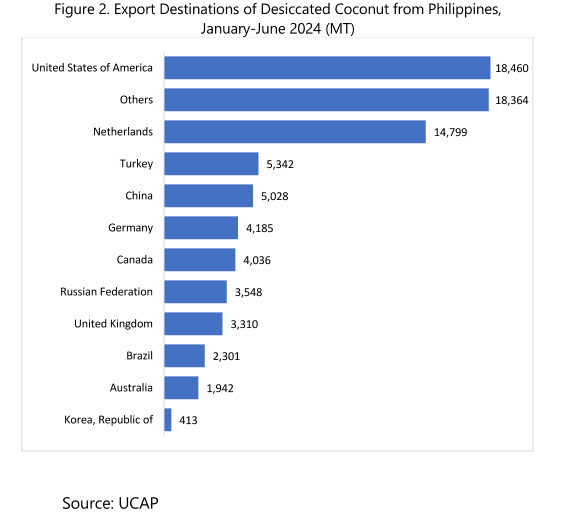

The Philippines, a leading global exporter of desiccated coconut, has shown a strong recovery in 2024. During January–June, the country exported 81,728 MT, marking a 9.5% increase compared to the same period in 2023. This rebound follows a marginal 0.4% decline in 2023, when total exports reached 156,274 MT. The resurgence highlights the resilience of demand, particularly in major markets.

The United States and the Netherlands were the top importers of Philippine desiccated coconut during this period, with imports of 18,460 MT and 18,364 MT, respectively. Other key markets included Turkey, China, Germany, and Canada, each importing over 4,000 MT. This diversified demand across North America, Europe, and Asia underscores the global reliance on desiccated coconut and intensifying competition for supplies.

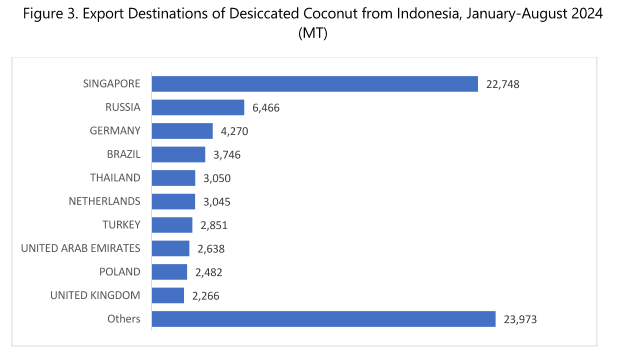

Indonesia, another major exporter, has also reported positive trends. Between January and August 2024, exports reached 77,536 MT, reflecting a 6% increase from the same period in 2023. This growth builds on a 3.2% annual increase in 2023, following a significant downturn in 2022. Indonesia’s steady recovery highlights the resilience of its coconut industry despite earlier challenges.

Key export markets for Indonesian desiccated coconut include Singapore, Russia, Germany, Brazil, Thailand, the Netherlands, and Turkey, all of which have maintained strong demand.

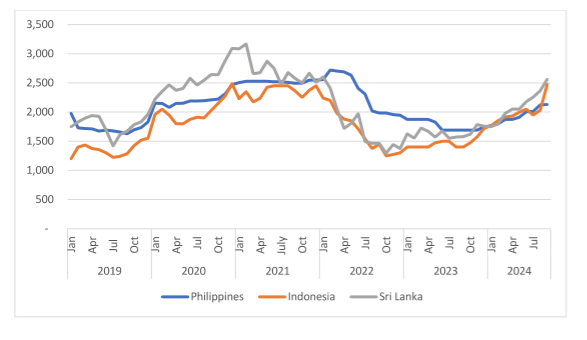

Rising global demand and constrained supply have driven significant price increases across major producing countries. In September 2024, the average export price of Philippine desiccated coconut reached $2,131 per MT, representing a 26% year-on-year increase. Indonesian prices climbed even higher, averaging $2,475 per MT, up 76.8% compared to the previous year. Sri Lanka, another key producer, reported an average price of $2,563 per MT, marking a 62% year-on-year increase. These price surges underscore tightening supply conditions amid robust global demand, highlighting the critical need for sustainable production and supply chain resilience in the face of economic and environmental challenges.

Global trade in desiccated coconut continues to reflect dynamic market forces. While leading markets like the EU exhibit steady growth, others such as the United States face challenges. On the supply side, the recovery of key exporters like the Philippines and Indonesia demonstrates the resilience of the industry despite price volatility and external pressures. As demand for plant-based and natural products grows, the desiccated coconut market remains poised for further evolution, with sustainability and innovation at its core.