- Home

- Statistics

- Market Review

Market Review of Dessicated Coconut

June 2023

The global demand for desiccated coconut is experiencing a significant upswing, with the Philippines and Indonesia emerging as key players in production and export of this commodity. According to data from the Philippine Statistics Authority, desiccated coconut exports from the Philippines have displayed an upward trend from 2019 to 2022. Similarly, Indonesia's exports of desiccated coconut have rebounded after a decline in 2019.

The Philippines witnessed consistent growth in desiccated coconut exports during the aforementioned period. In 2019, the country exported 147,594 metric tons, which dipped slightly to 145,200 metric tons in 2020 but recovered to 160,117 metric tons in 2021 and maintained a steady 156,930 tons in 2022. Furthermore, the latest data for the first two months of 2023 demonstrates a continued upward trajectory, with an export volume of 34,643 metric tons. Although this figure represents a 23% decline compared to the same period last year, it indicates sustained demand.

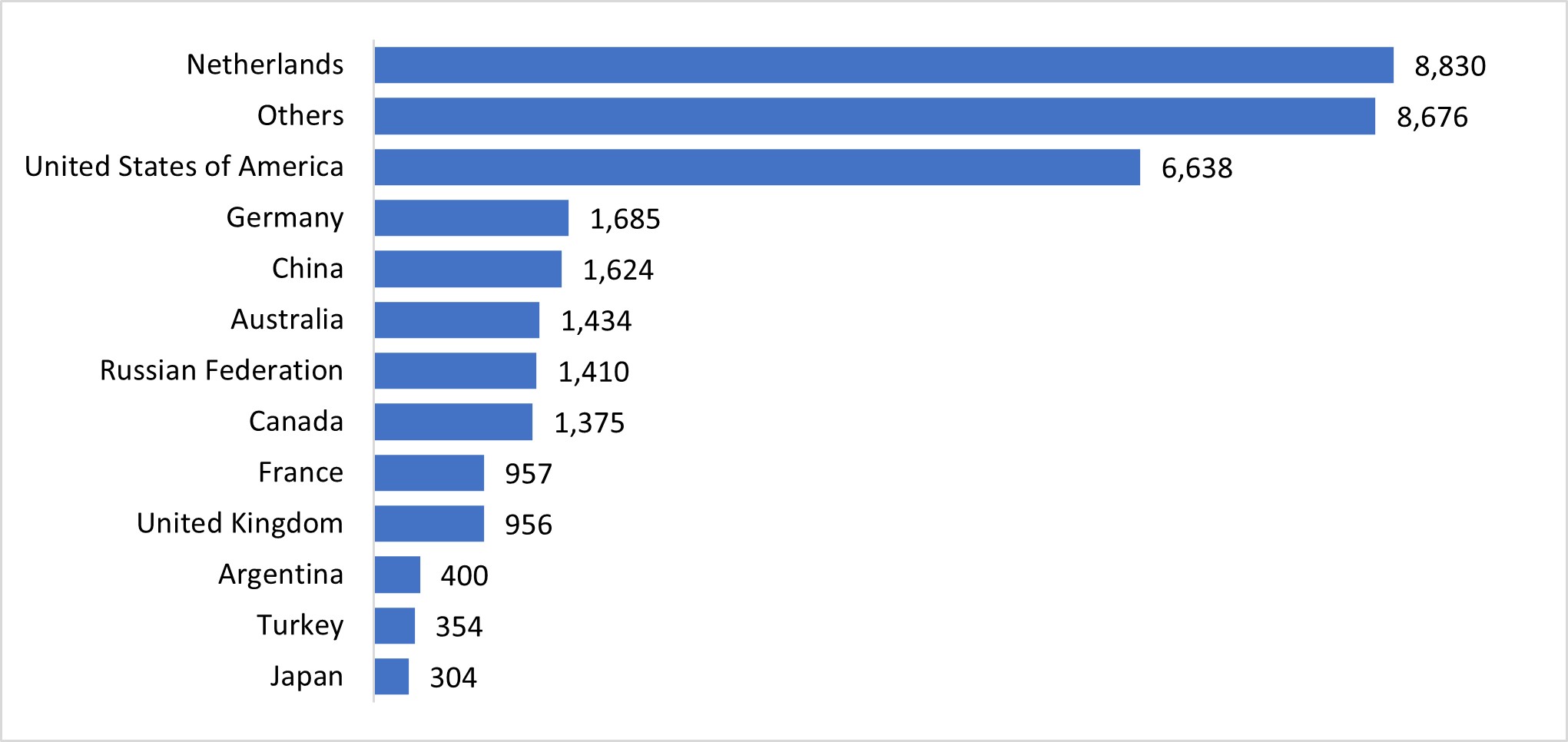

In terms of export destinations, the top countries for Philippine desiccated coconut exports during January-March 2023 were the Netherlands and the United States of America, importing 8,830 metric tons and 8,676 metric tons respectively. Additional significant destinations included Germany, China, Australia, Russia, and Canada, each importing over 1,000 metric tons. This data underscores the strong demand for desiccated coconut across North America, Europe, and Asia.

Figure 1. Export Destinations of Desiccated Coconut from Philippines, January-March 2023 (MT)

Indonesia's desiccated coconut exports experienced a decline in 2019 but have since recovered. In 2018, Indonesia exported 109,181 metric tons, which decreased to 98,742 metric tons in 2019 but then increased to 128,087 metric tons in 2020. The upward trend continued in 2021, with exports reaching 139,932 metric tons. However, the latest data for 2022 indicates a decline to 110,455 metric tons. During the first four months of 2023, Indonesia's export volume stood at 33,893 metric tons, lower than the 2022 volume of 40,834 tons.

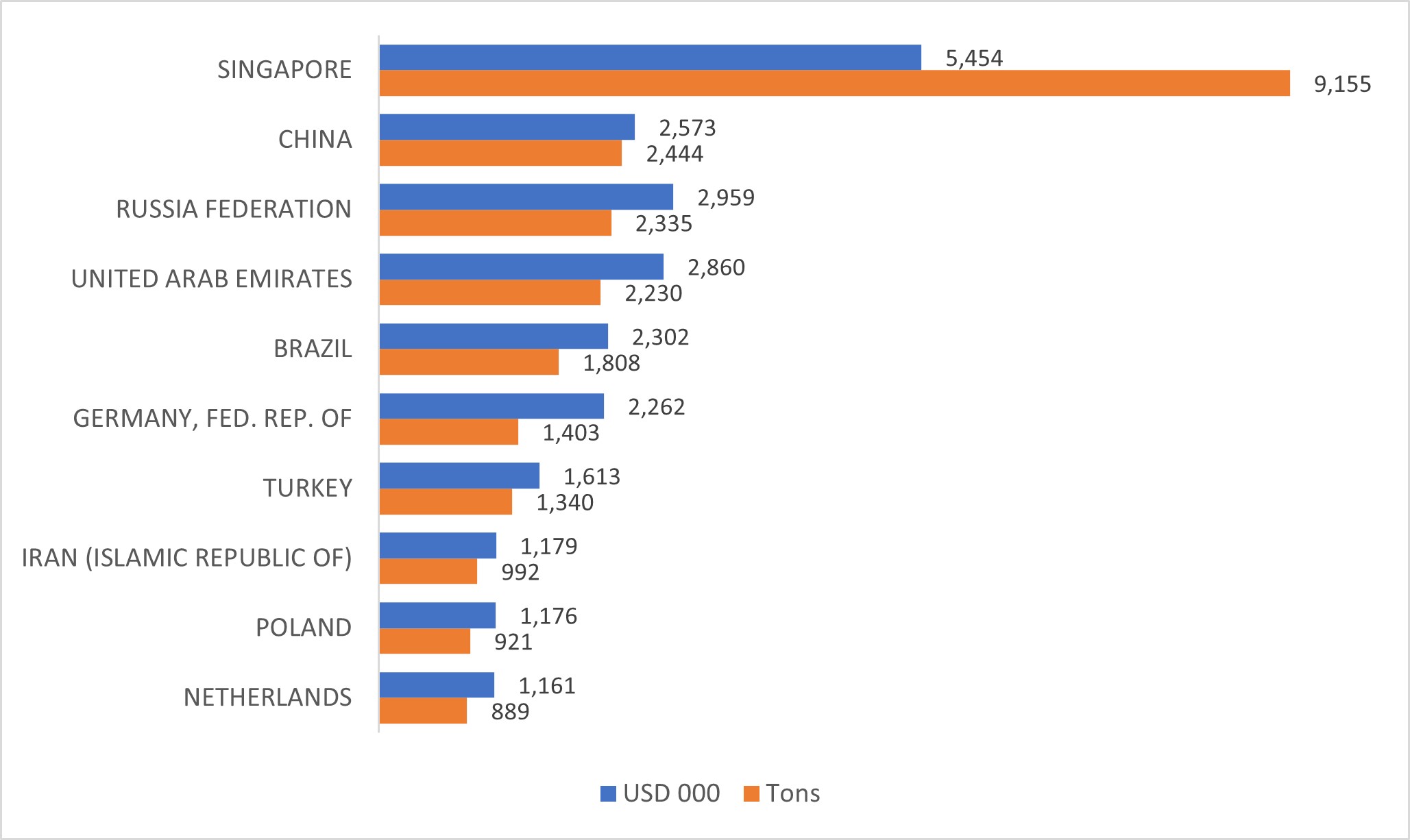

Indonesia's primary export markets for desiccated coconut are the European Union (EU27), followed by Singapore and the Russian Federation. China and Brazil also represent significant importers. In the January-April 2023 period, the main destinations for Indonesian desiccated coconut were Singapore, China, Russia, UAE, Brazil, Germany, and Turkey.

Figure 2. Top 10 Export Destinations of Desiccated Coconut from Indonesia, January-April 2023

While there has been a significant decrease in global imports of desiccated coconut from 2021 to 2022, with a decline of 29.7%, this was primarily driven by diminishing demand in European countries. Import volumes in the EU27 dropped by 7.8% during CY2022. In contrast, US imports continued to increase by 1.5%. However, considering the overall trend over the past decade, both the EU27 and the US have exhibited a slight increase in demand for desiccated coconut, with compound annual growth rates (CAGR) of 1.8% and 3.6% respectively.

Table 1. Import Volume (MT) of Desiccated Coconut, 2013-2022

| Year | World | EU27 | US |

| 2014 | 420,373 | 103,376 | 52,259 |

| 2015 | 440,774 | 94,421 | 53,696 |

| 2016 | 423,896 | 104,508 | 48,107 |

| 2017 | 439,129 | 111,551 | 46,590 |

| 2018 | 458,789 | 108,320 | 48,067 |

| 2019 | 451,727 | 103,385 | 45,531 |

| 2020 | 483,005 | 100,657 | 41,056 |

| 2021 | 517,302 | 115,103 | 53,568 |

| 2022 | 370,128 | 118,291 | 54,372 |

| Jan-Apr 2023* | 58,616 | 27,664 | 13,432 |

Source: ITC and US Census Bureau *: preliminary figures

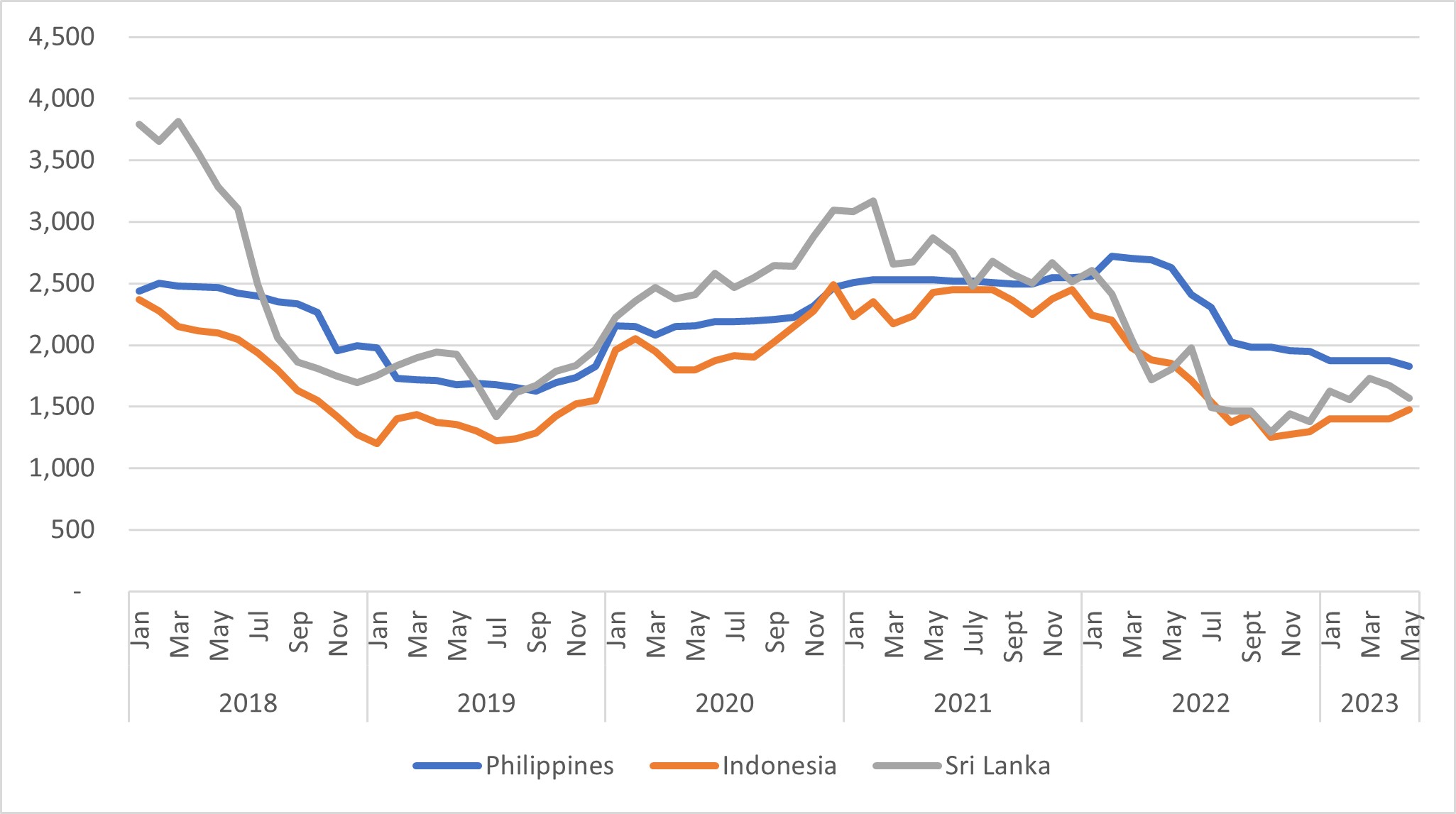

The prices of desiccated coconut showed a declining trend throughout 2022 in the Philippines, Indonesia, and Sri Lanka. In February 2022, the price of desiccated coconut in the Philippines peaked at US$2,721/MT, but by December 2022, it had decreased to US$1,947/MT. Similarly, Indonesia and Sri Lanka experienced price drops of 29% and 21% respectively over the course of the year. During the first five months of 2023, desiccated coconut prices remained weak, with an average price of US$1,865/MT in the Philippines, US$1,415/MT in Indonesia, and US$1,630/MT in Sri Lanka.

Figure 3. Monthly Price of Desiccated Coconut (US$/MT), January 2018- May 2023

One possible contributing factor to the declining prices is the high inflation rate observed in several European countries and the US, which may have reduced consumer purchasing power and consequently dampened demand for coconut products, including desiccated coconut. Additionally, an anticipated economic slowdown in the near future could further affect demand and prices in this market.