- Home

- Statistics

- Market Review

Market Review of Coconut Activated Carbon

April 2025

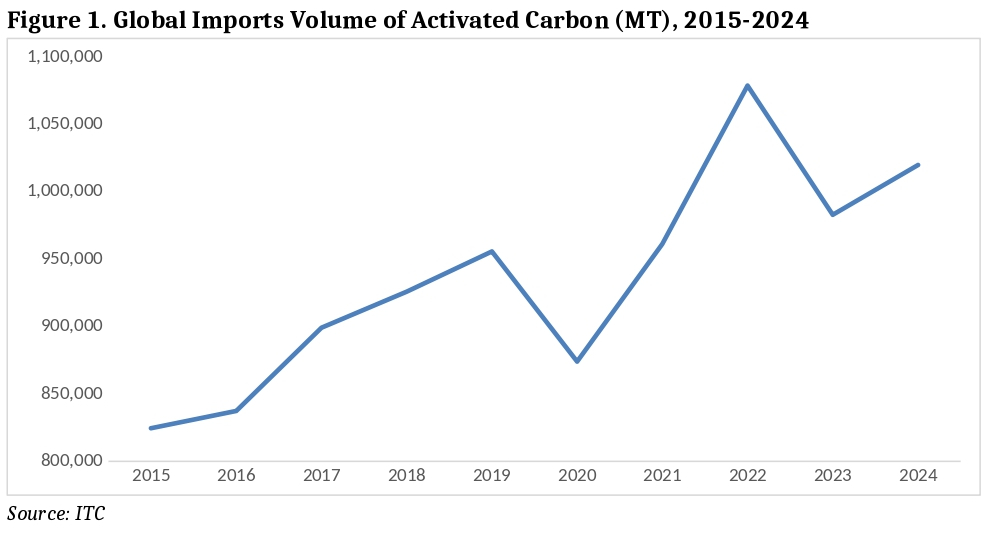

In 2024, global imports of activated carbon reached 1,019,804 metric tons (MT), marking a 3.8% increase from 2023. This modest recovery follows a sharp drop from the 2022 peak of 1,078,708 MT, when post-pandemic demand drove exceptional growth. Despite not returning to the 2022 high, the 2024 import level is the second highest in the past decade, indicating a stabilization of global trade and sustained demand across key sectors.

The long-term trend since 2015 shows overall growth, with brief setbacks during the pandemic in 2020 and a correction in 2023. The 2024 rebound suggests renewed momentum in industrial, environmental, and purification applications, reflecting the resilience of the activated carbon market and the gradual normalization of global supply chains.

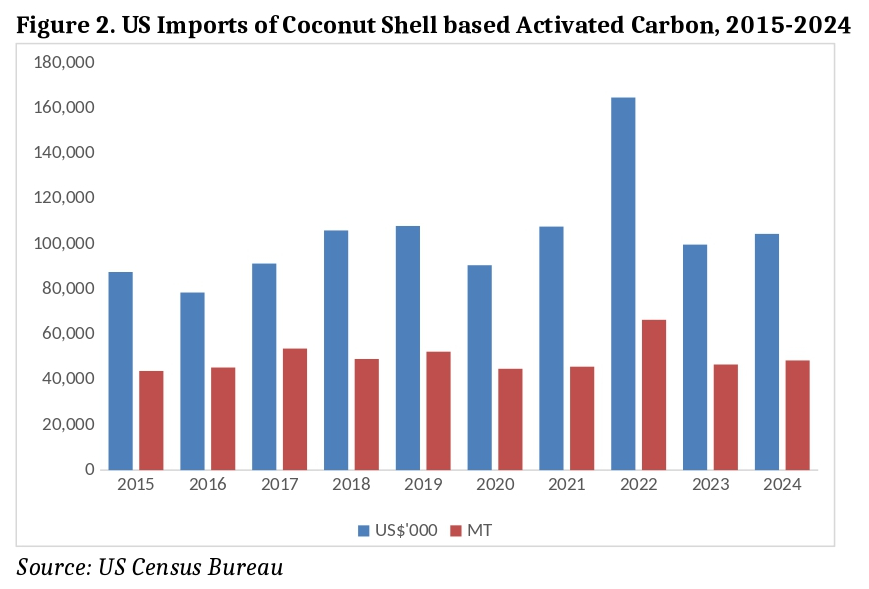

U.S. imports of coconut shell-based activated carbon in 2024 totaled 48,498 MT, valued at US$104.4 million. This represents a modest increase from 2023 (46,663 MT, US$99.7 million), indicating a slight recovery in both volume and value. However, figures remain well below the 2022 peak of 66,432 MT and US$164.7 million, suggesting ongoing adjustments in inventory and pricing. The relatively steady increase in volume and value points to market normalization and stable pricing dynamics.

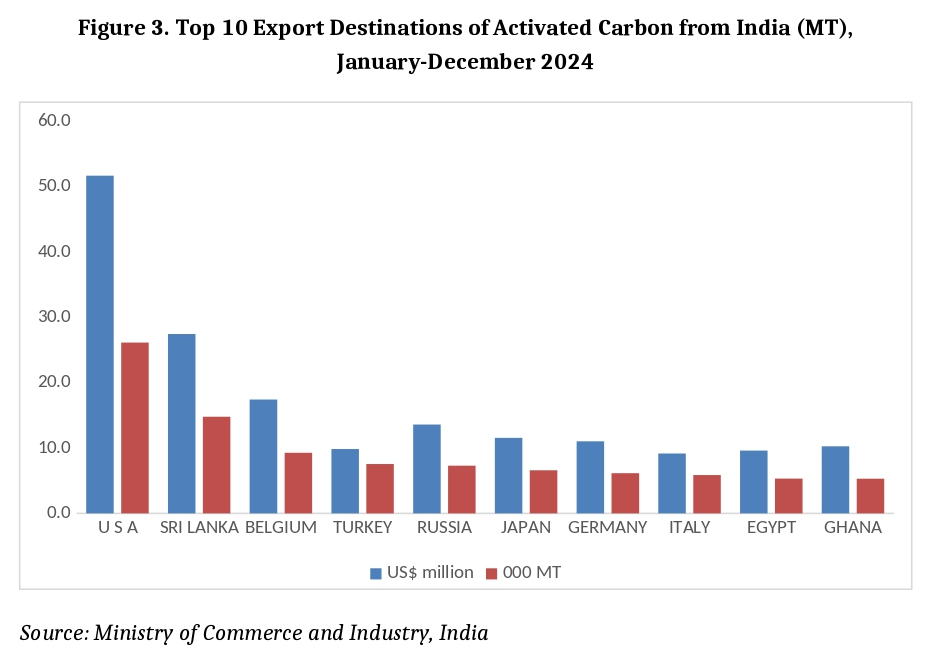

India saw strong export growth in 2024, with activated carbon shipments rising by 25.4% in volume (177,940 MT) and 28.4% in value (US$310.96 million) compared to 2023. This growth underscores India’s increasing competitiveness and rising global demand for its products, especially in applications such as air purification and water treatment. Major export markets like the U.S., Sri Lanka, and Belgium recorded significant growth, while some, such as Türkiye and Germany, showed signs of saturation or heightened competition.

Sri Lanka’s activated carbon exports grew by 13.3% in volume to 58,381 MT and by 21.9% in value to US$151.21 million in 2024. The strongest monthly performance occurred in December, with record shipments (5,285 MT) and earnings (US$14.34 million), indicating strong year-end demand. Monthly data also show consistent improvements over 2023, suggesting higher unit prices or value-added product exports. This robust growth highlights Sri Lanka’s strategic positioning in the global market.

Indonesia’s exports of coconut shell-based activated carbon declined in 2024, with volume down 9% to 17,097 MT and value falling 18% to US$23.4 million. The sharper decline in value signals lower unit prices and softening demand. Although exports showed partial recovery late in the year, overall performance remained below 2023 levels, likely due to increased competition and shifting demand patterns.

The Philippines saw a marginal decline in exports, with volume down 0.5% to 58,692 MT and value slipping 0.8% to US$97.4 million. While the first half of the year underperformed, strong shipments in July and October helped stabilize annual figures. Price per MT remained relatively steady, indicating volume as the primary driver of change.

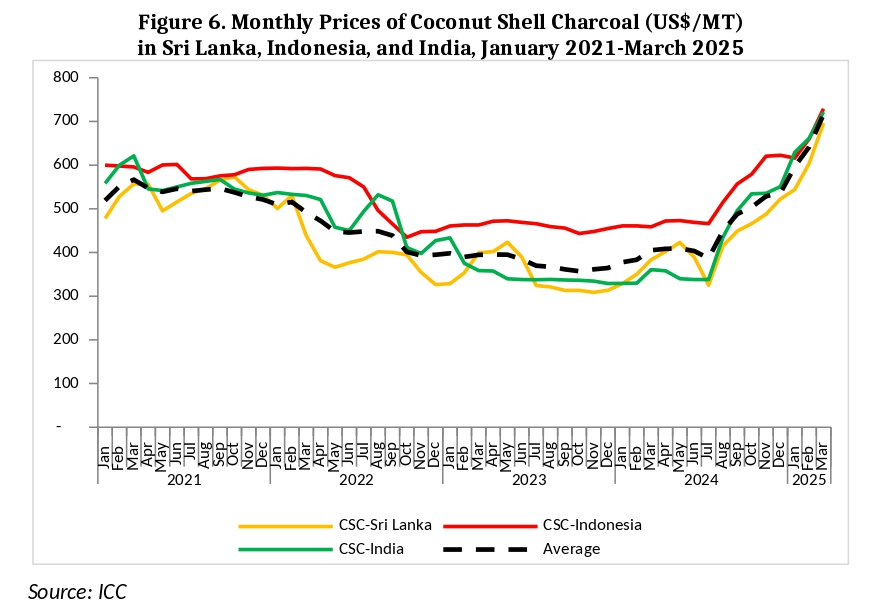

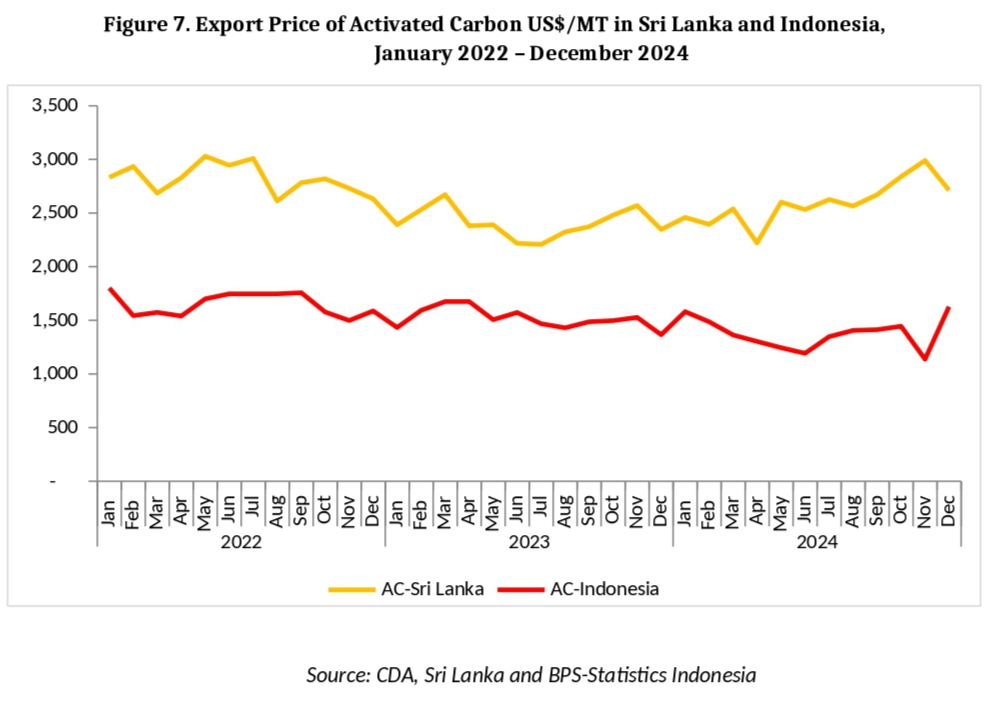

Coconut shell charcoal prices rose sharply across key producing countries in 2024 and early 2025 due to tightening supplies and recovering demand. Indonesia’s prices surged from US$461/MT in January 2024 to US$729/MT by March 2025. India experienced a similar climb, from US$329 to US$722/MT. Activated carbon prices also increased, with Sri Lanka reporting a rise from US$2,346/MT in December 2023 to US$2,713/MT in December 2024. In contrast, Indonesia’s export prices remained relatively subdued.

Indonesia The market outlook remains cautiously optimistic. Demand from water treatment, air purification, food processing, and energy storage continues to grow, particularly favoring coconut shell-based carbon for its renewable nature and high adsorption capacity. The Asia-Pacific region is poised for continued growth, while premium pricing in developed markets is supported by stringent environmental regulations. However, trade risks persist. Tariff barriers imposed by the U.S. under the Trump administration still affect global flows, especially for Asian exporters. While some benefit from trade diversion, others face margin pressure and must diversify markets. As such, despite favorable fundamentals, trade policy and price volatility will shape the industry landscape through 2025.