- Home

- Statistics

- Market Review

Market Review of Coconut Oil

September 2024

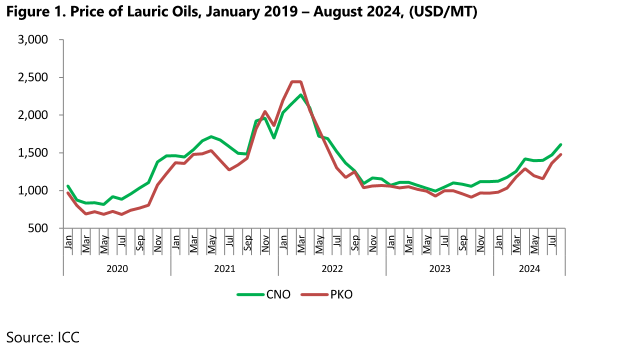

In 2024, the global market for lauric oils experienced significant price increases, mainly driven by constrained supply. Between January and August, the price of palm oil rose sharply from US$978 per metric ton (MT) to US$1,480 per MT, while coconut oil prices increased from US$1,126 per MT to US$1,610 per MT over the same period. These trends underscore the tight supply conditions and escalating demand that continue to shape the market, with further price increases anticipated in the coming months.

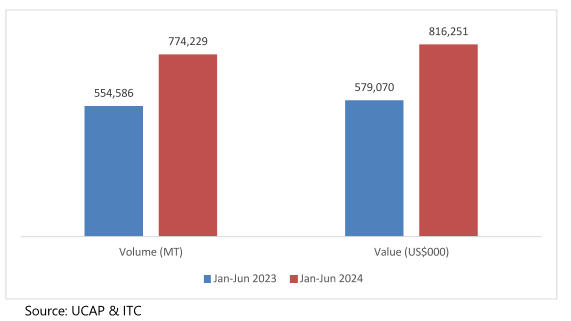

The supply dynamics in key producing countries during the first half of 2024 reflected varying performances. The Philippines, as a leading exporter of coconut oil, reported a significant increase in exports. Data from the United Coconut Association of the Philippines showed that exports reached 774,229 tons, generating US$816.3 million in revenue, a 44.8% increase in volume compared to the same period in 2023. This surge was fueled by heightened global demand and improved supply. Major destinations for these exports included the Netherlands, the United States, and Malaysia.

Figure 2. Philippines’ Export of Coconut Oil, Jan-Jun 2023/24

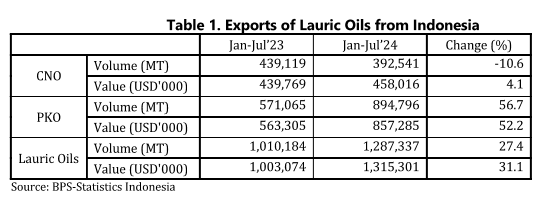

In contrast, Indonesia faced challenges in maintaining its coconut oil export volumes. Shipments decreased by 10.6%, totaling 392,541 MT during the first seven months of 2024. Despite this decline, export earnings rose to US$458 million from US$439.8 million, reflecting higher unit prices. Key export markets included the Netherlands, China, Sri Lanka, Philippines, Malaysia, and the United States. The decrease in export volume was primarily due to limited raw material availability, with reduced coconut production affecting copra supplies. This shortage led to a significant rise in the prices of coconuts and copra, further straining supply chains.

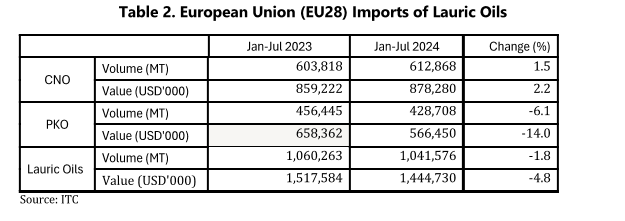

Demand in major markets such as Europe and the United States also exhibited notable changes during this period. In Europe, lauric oil imports declined by 4.8% between January and July 2024, primarily due to a 6.1% reduction in palm kernel oil imports. However, demand for coconut oil rose by 1.5%, reflecting a shift in preference driven by the anticipated implementation of the European Union Deforestation Regulation (EUDR), which targets commodities like palm oil.

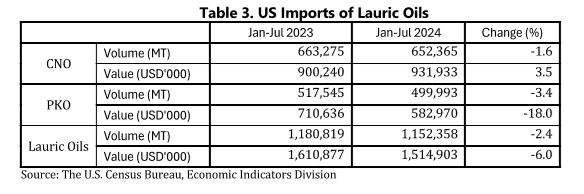

In the United States, lauric oil imports decreased by 2.4% during the same period, influenced by a 3.4% drop in palm kernel oil imports and a 1.6% decline in coconut oil imports. The economic slowdown in the United States was a significant factor contributing to this decrease, as reduced economic activity dampened overall demand.

The developments in the lauric oils market during 2024 highlight a complex interplay of supply constraints, price volatility, and shifting consumption patterns. While the Philippines leveraged strong global demand to achieve record export volumes, Indonesia faced production challenges that constrained supply. Meanwhile, evolving regulatory frameworks and economic conditions in Europe and the United States are reshaping global trade flows, favoring certain oils over others. As the year progresses, these factors are expected to continue influencing the market, with prices likely to remain on an upward trajectory.