- Home

- Statistics

- Market Review

Market Review of Coconut Oil

May 2025

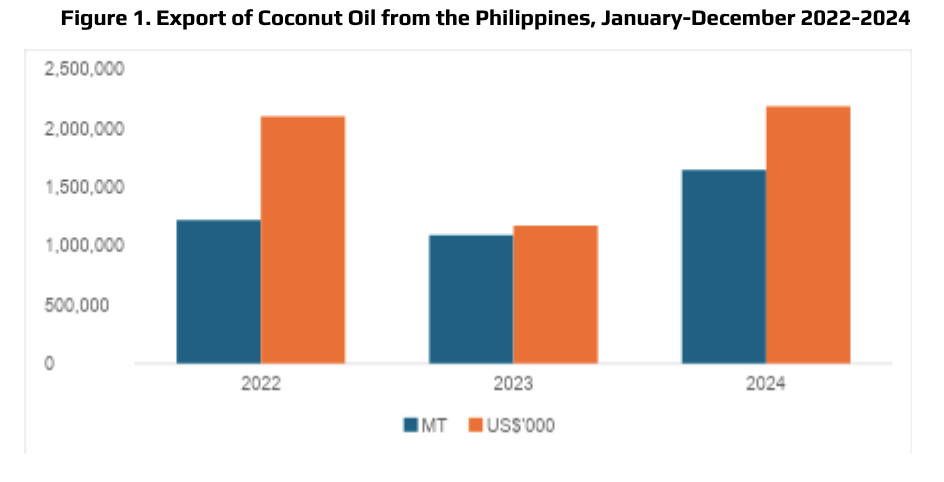

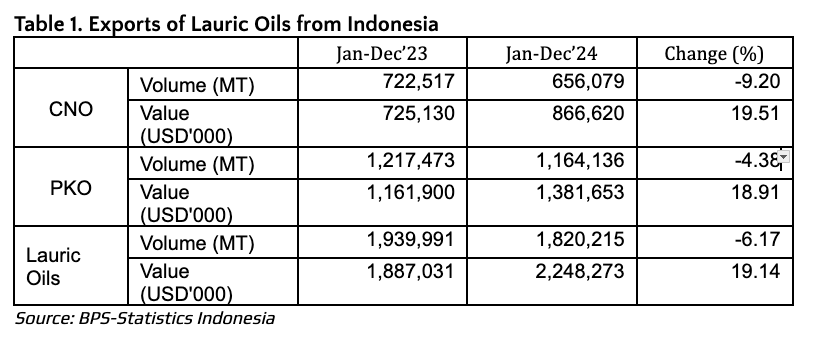

In 2024, the global supply of lauric oils experienced notable fluctuations, driven by varying production trends among key producing countries. The Philippines demonstrated a robust recovery in coconut oil exports, with volumes increasing by 51% to reach 1.64 million metric tons—the highest level on record. This surge reflects strengthened demand, likely attributable to supply shortages in other producing regions. Conversely, Indonesia experienced a decline in supply, with coconut oil exports falling by 9.2%, palm kernel oil exports decreasing by 4.38%, and total lauric oil exports contracting by 6.17%. These reductions were partially caused by adverse weather conditions and reduced milling output, particularly impacting palm kernel oil production.

Oil World (May 2025) forecasts a 2.5% year-on-year decline in global coconut oil output in the 2024/25 season. This is primarily due to El Niño-induced droughts impacting copra production in the Philippines and Indonesia. Meanwhile, PKO production is expected to grow by only 1.2% during the same period, constrained by limited expansion in palm oil areas and slower fresh fruit bunch (FFB) growth. The tight supply outlook suggests continued pressure on both lauric oil markets into 2025.

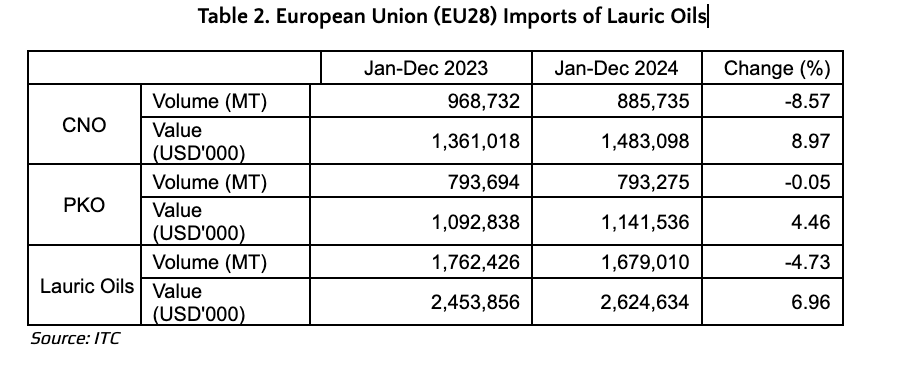

On the demand side, industrial consumption remained robust throughout 2024, especially in the oleochemical and biofuel sectors. In the European Union, total coconut oil imports dropped by 8.6% to 885,735 metric tons due to supply constraints, but demand stayed steady, pushing up unit import values. PKO imports into the EU remained relatively stable in volume and grew modestly in value, highlighting its continued importance for industrial users. The Philippines and Indonesia maintained their position as dominant suppliers to the EU, accounting for over 85% of lauric oil imports.

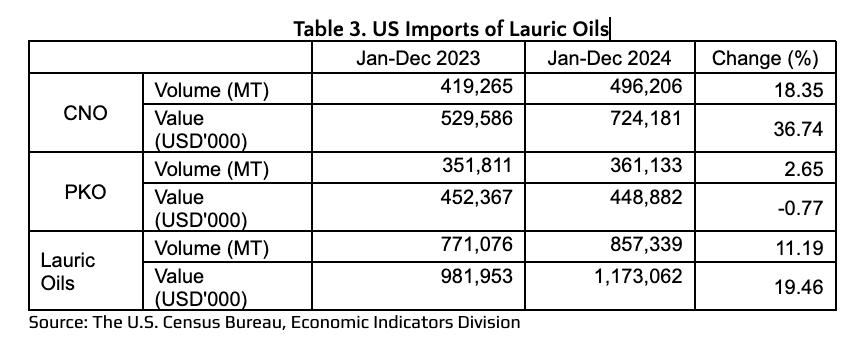

In the United States, demand was notably strong, with total lauric oil imports rising by 11.2% to 857,339 metric tons. CNO drove most of this growth, with import volumes up 18.4% and value up 36.7%. PKO volumes were largely stable, with a modest 2.7% increase, but value declined slightly due to shifting product mixes. The reintroduction of U.S. import tariffs in early 2025 (ranging from 18–46%) is expected to influence buying behavior, potentially dampening demand or diverting trade flows toward Europe or Asia, depending on tariff impacts and global price trends.

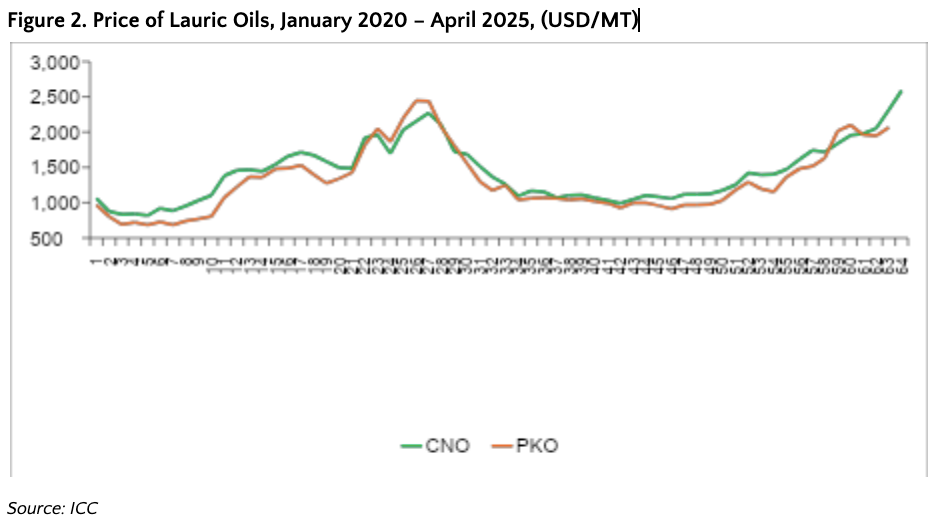

Price developments in 2024 were marked by a strong recovery, especially in the second half of the year. Coconut oil prices rose by 73%, from USD 1,126 per metric ton in January to USD 1,949 in December. Palm kernel oil saw even steeper gains, rising 115% over the same period from USD 978 to USD 2,099 per metric ton. This surge was driven by the tightening supply situation, strong industrial demand, and speculative buying amid market uncertainty. Notably, PKO prices surpassed those of CNO starting in November—an unusual reversal of the historical price relationship. This shift reflects the increasing industrial preference for PKO in renewable fuel applications and oleochemical derivatives, especially in Europe, where decarbonization targets are driving feedstock substitution.

As of early 2025, lauric oil prices remain elevated. Between January and April 2025, CNO prices jumped 31% to USD 2,587/MT, while PKO rose by 6.5%. With limited near-term supply growth and sustained demand from bio-based industries, lauric oil prices are expected to stay high in the coming months. However, if soft oils such as palm oil and soybean oil become more competitively priced, some substitution could cap further price gains.

In summary, 2024 marked a pivotal year for the lauric oils market, with tight supply conditions, resilient demand, and sharply rising prices that are likely to shape market behavior well into 2025.