- Home

- Statistics

- Market Review

Market Review of Coconut Fiber

November 2024

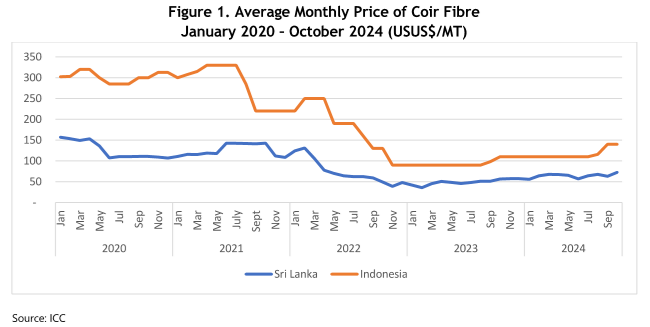

The coir fiber market in Sri Lanka and Indonesia has experienced dynamic shifts from 2020 to 2024, with 2024 marking a significant recovery in prices and demand. In Sri Lanka, after facing a sharp decline in prices during 2022 and 2023, the market has rebounded impressively. Prices climbed steadily from US$56 per metric ton (MT) in January to US$73 per MT in October, reflecting renewed domestic and international demand. This upward trajectory is a marked recovery from 2022 lows of US$39 per MT and is supported by improved production and supply conditions.

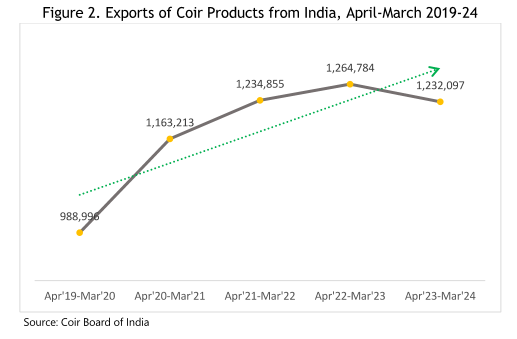

Indonesia’s coir market, while historically more stable, saw notable price growth in 2024. Prices, which had remained at US$90 per MT throughout much of 2023, surged to US$140 per MT by September and October. This represents the highest levels since 2020 and points to tightening supply or rising demand. Unlike Sri Lanka, Indonesia avoided the sharp price drops of 2022, maintaining relative stability. However, it is important to note that Indonesia predominantly exports low-value products such as coir fiber and coir pith, which limits its ability to capture higher margins or compete in premium market segments. India’s coir export data from April 2019 to March 2024 illustrates the impact of fluctuating global demand and pricing. The highest export quantity, 1.26 million MT, was recorded between April 2022 and March 2023, but the export value dropped to US$485.8 million, reflecting lower unit prices despite high volumes. The subsequent period saw a slight decrease in quantity to 1.23 million MT, while export value plummeted to US$407.3 million, the lowest in five years. This decline underscores global market challenges, such as falling prices and heightened competition, necessitating strategies for value addition, market diversification, and competitive positioning.

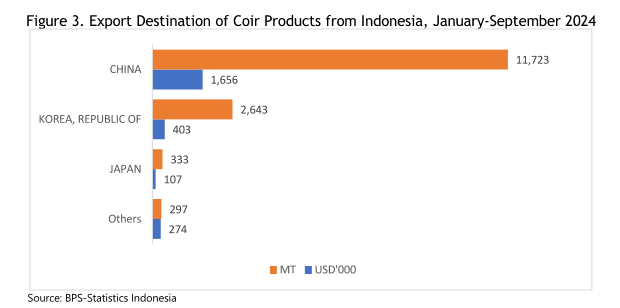

Indonesian coir exports during the first nine months of 2024 also reveal a decline in value and quantity. Export value dropped from US$3.63 million in 2023 to US$2.44 million in 2024, and quantities decreased from 20.27 million kg to 14.99 million kg. Notably, exports to China, Indonesia’s largest market, declined in both value and volume, suggesting weaker demand or market saturation. Similarly, exports to South Korea sharply decreased, indicating competitive pressures or shifting market preferences. This reflects Indonesia’s reliance on low-value coir products, which face significant price competition.

Conversely, some markets displayed growth, hinting at opportunities for premium products. Exports to Japan increased in value from US$90,724 in 2023 to US$106,532 in 2024, despite a reduction in quantity, reflecting a shift toward higher-quality offerings. Exports to Singapore and France also grew substantially, signaling a preference for specialized coir goods. These trends suggest that Indonesia can diversify its product portfolio by focusing on innovation and premium lines to navigate global price pressures and strengthen market presence.

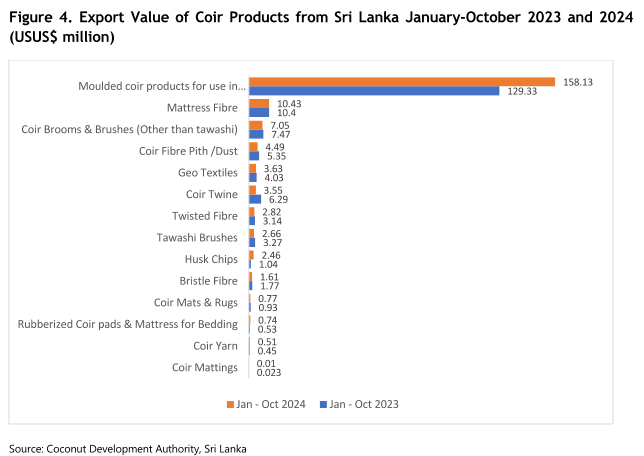

Sri Lanka's coir exports showed notable growth between January and October 2024, with total export value rising by 14.3% from US$174.02 million in 2023 to US$198.86 million. This growth was driven by strong demand for molded coir products used in horticulture, which saw a 22.3% increase in export value. China and Japan were key importers, with China's imports rising 21%, highlighting robust demand for eco-friendly coir products. Despite declines in certain categories like coir twine and bristle fiber, others, such as husk chips, experienced remarkable growth of 136.5%, underscoring the increasing use of coir by-products in sustainable agriculture.

European markets continued to play a significant role in Sri Lanka’s coir trade, with steady demand from countries like the Netherlands and Germany. However, some markets, including Belgium and Hungary, showed declines, reflecting shifting dynamics within the European market. This reinforces the need for producers to adapt to evolving preferences and focus on high-value offerings.

The global coir industry has demonstrated resilience and adaptability amid challenges. Sri Lanka and Indonesia are recovering from past declines, with Sri Lanka exhibiting steady growth and Indonesia seeking to elevate its market presence by diversifying beyond low-value products. Meanwhile, India faces hurdles like falling prices and intense competition but holds opportunities in value-added products and emerging markets. The outlook for coir remains positive, driven by growing demand for sustainable, eco-friendly solutions in horticulture and agriculture. Producers who innovate and align with global preferences for quality and sustainability will be best positioned to thrive in the evolving marketplace.