- Home

- Statistics

- Market Review

Market Review of Coconut Fiber

July 2023

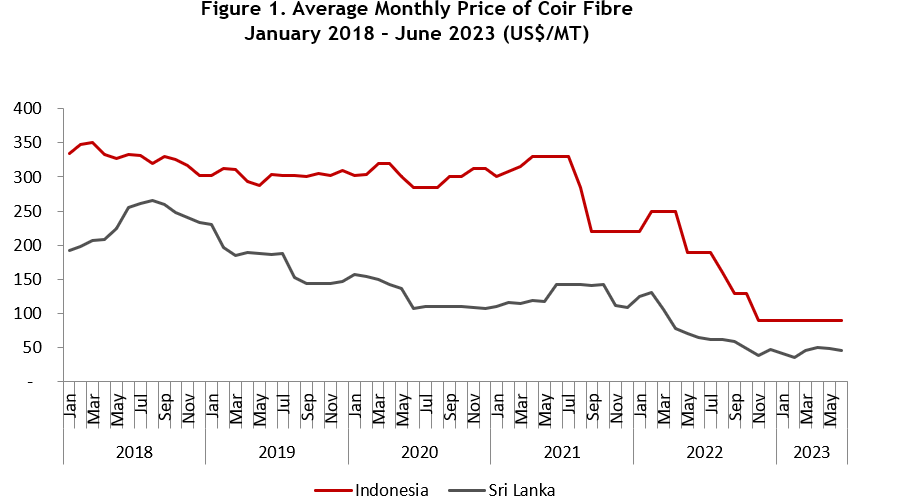

During the initial half of 2023, the coir fibre market exhibited subdued pricing levels subsequent to a decline observed in the preceding year. Notably, in Indonesia, the coir fibre price stabilized at a value of US$90 per metric ton during this period. A parallel trend was witnessed in Sri Lanka, where the average coir fibre price during January to June 2023 remained modest, recorded at USD45 per metric ton.

This diminution in prices can be primarily attributed to a pronounced dependency on the Chinese market for sourcing raw materials. The outbreak of the Covid-19 pandemic engendered a substantial closure of the Chinese market, thereby disrupting the coherent supply chain for coir fibre and subsequently precipitating a considerable contraction in demand. This perturbation exerted notable downward pressure on prices, culminating in the substantial discounts that pervaded the market milieu.

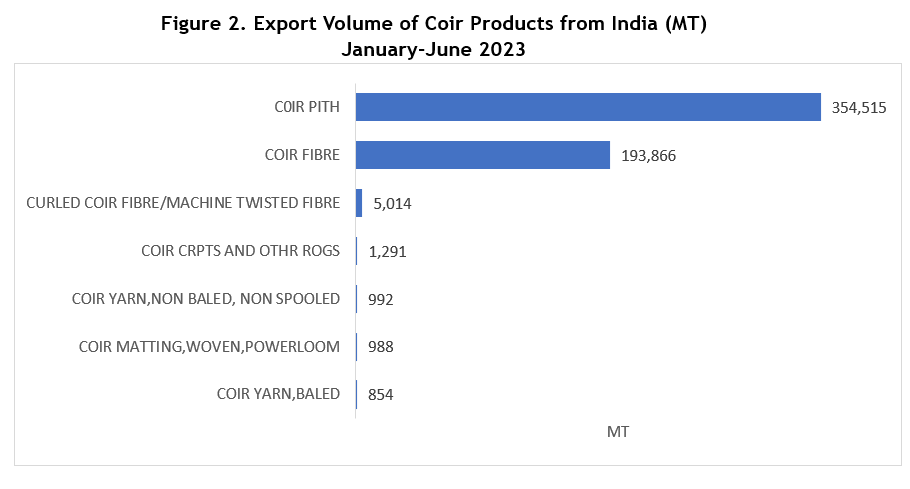

Despite the multifarious challenges encountered by the coir market since the commencement of 2022, India, Indonesia, and Sri Lanka continued to assert their positions as principal exporters of coir-based commodities. According to the latest report from the Ministry of Commerce and Industry of India, the first half of 2023 witnessed an aggregate shipment volume of 557.5 thousand tons of coir and related products from India to the global marketplace. These exports accrued revenue totalling US$145 million, albeit marking an 11.7% contraction vis-à-vis the corresponding period in the preceding year. Prevalent within this export portfolio, coir pith and fibre persisted as the predominant product categories, collectively constituting over 98% of the aggregate volume and contributing 91% of the total export revenue during the aforementioned period.

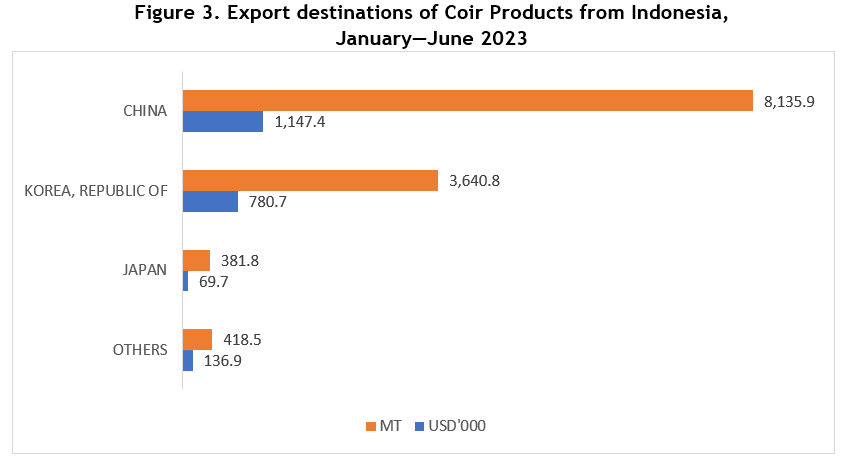

Concurrently, Indonesia's export volume of coir-based products during the January-June 2023 interval amounted to 12,577 metric tons, depicting a discernible 19% contraction relative to the commensurate period in the antecedent year, indicative of a palpable diminishment. In congruence with this volume contraction, export valuation exhibited a corresponding decline of 36%, emblematic of the attenuated pricing climate. China, South Korea, and Japan continued to persist as pivotal destinations for Indonesian coir products, jointly accounting for more than 97% of the total volume of coir commodities exported. Notably, coir fibre and coir pith constituted the principal product categories dispatched from Indonesia to the global export arena.

Simultaneously, Sri Lanka recorded an appreciable augmentation in export revenue pertaining to coir-based products during the inaugural half of 2023. This marginal appreciation amounted to 1.27%, elevating the revenue from US$103.6 million during January-June 2022 to US$104.9 million during the corresponding timeframe in 2023. An instrumental driver of this escalation was the category of moulded coir products intended for horticultural utilization, a consistent frontrunner in Sri Lanka's coir export repertoire. These horticulturally oriented coir products notably contributed US$76.2 million, encompassing a significant proportion of more than 73% of the overall export value. This valuation marked a marginal uplift of 2% in comparison to the previous year's corresponding figures. Concomitantly, other product categories, including mattress fibre, twisted fibre, and coir pith, significantly bolstered the export revenue stream.

Foremost among the destinations for Sri Lanka's moulded coir products utilized in horticulture were Mexico, China, Morocco, Japan, South Korea, and Turkey. This assortment of markets collectively absorbed a substantial proportion of Sri Lanka's coir exports, underscoring the diversified global demand for these specialized commodities.

In conclusion, the coir fibre market landscape in the first half of 2023 is marked by intricate dynamics influenced by multifaceted factors. The prevailing trend of subdued coir fibre prices, as evidenced in Indonesia and Sri Lanka, can be ascribed primarily to the pronounced disruption in the global supply chain, particularly due to the ramifications of the Covid-19 pandemic. The consequential closure of the Chinese market, a pivotal hub in the coir industry's raw material sourcing and demand equation, played a pivotal role in exerting downward pressure on prices.

India, Indonesia, and Sri Lanka have persistently maintained their roles as dominant exporters of coir-related commodities, despite grappling with the challenges posed by the evolving market dynamics since the preceding year. The Indian coir export landscape, while exhibiting a dip in volume compared to the previous year, remained substantive in terms of both volume and revenue. Coir pith and fibre remained the linchpins of this export portfolio, substantiating their integral role within the industry.

In Indonesia, the volume and value contractions in coir-based exports underscore the pronounced impact of the pricing climate and the concomitant challenges. However, strategic diversification across export destinations remains notable, with China, South Korea, and Japan collectively absorbing the majority of Indonesian coir exports.

Sri Lanka's coir export narrative in the initial half of 2023 is characterized by resilience, as evidenced by a marginal rise in export revenue. The contribution of moulded coir products geared towards horticultural applications stands out, forming a substantial portion of the overall export revenue. The market's receptiveness to these specialized products is exemplified by a diverse range of export destinations, reflecting the global demand for such commodities.

In totality, the coir fibre market's trajectory in the first half of 2023 underscores the complex interplay of market dynamics, supply chain disruptions, and demand shifts, culminating in distinct trends across different key players in the industry. As the global landscape continues to evolve, these insights provide a foundational understanding of the forces shaping the coir industry's performance and prospects.