- Home

- Statistics

- Market Review

Market Review of Coconut Shell Charcoal

December 2023

The global activated carbon market is poised for a slowdown in 2023 amid heightened economic instability on a global scale. Specifically, the United States, the largest importer of coconut shell-based activated carbon, experienced a substantial 29.4% reduction in imports during January-November 2023. This decline is noteworthy given the impressive 45% increase in U.S. import volume of activated carbon, reaching 66,470 tons in 2022. The decreased import activity is primarily attributed to the prevailing economic slowdown in the country.

Contrastingly, Japan saw a 2% increase in activated carbon imports during the January-September 2023 period compared to the corresponding period in 2022. This growth follows the upward trend in 2022, which recorded an import volume of 86,191 tons of activated carbon, marking a 2% increase and valued at US$168.17 million. This surge is linked to heightened usage in water treatment and air purification, as well as the expanding food and beverage processing industry.

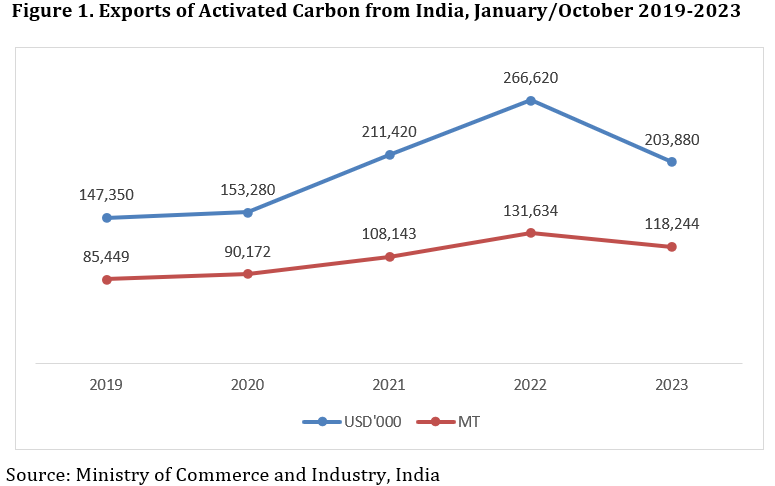

On the supply side, India, a prominent activated carbon producer, shipped 118,244 tons to the global market during the January-October 2023 period, reflecting a 10.2% reduction in export volume compared to the corresponding period in the previous year. This is noteworthy considering India's positive growth in export volume during 2019-2022, with an average growth rate of 15%. India exported activated carbon to 155 nations worldwide in the first half of 2023, with the United States maintaining its position as the primary importer.

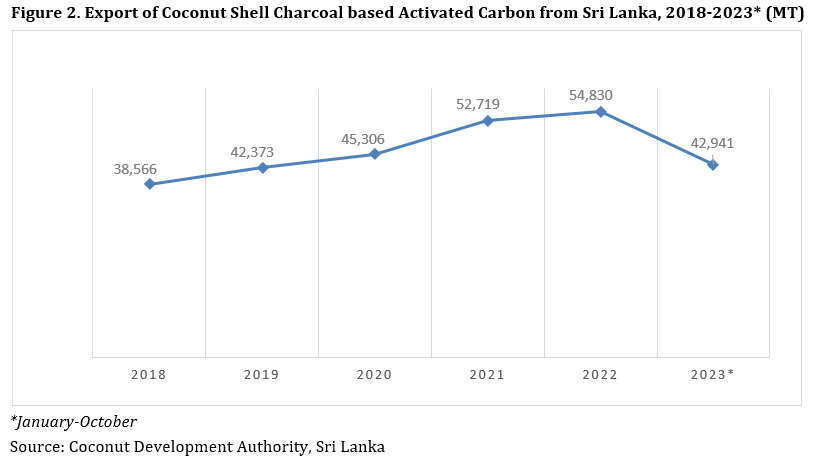

Sri Lanka, another significant producer of coconut shell-based activated carbon, faced a negative trend in 2023. The export volume of coconut shell charcoal-based activated carbon from Sri Lanka declined by 5% to 42,941 tons during January-October 2023, generating export earnings of USD 102.9 million, a 23.5% decrease from the same period in 2022. Despite enjoying an increasing trend in export volume during 2018-2022 with a CAGR of 9.2%, key importers of Sri Lankan activated carbon, including the United States, China, Japan, Germany, and the United Kingdom, experienced reduced demand.

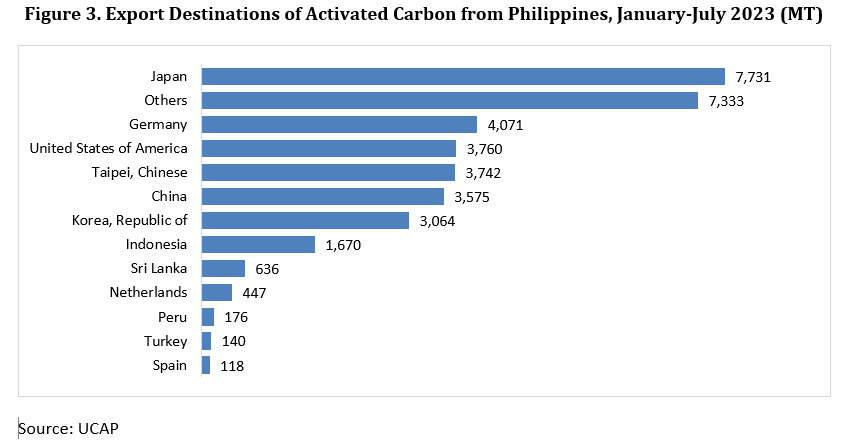

The Philippines also observed a reduction in activated carbon exports, with shipments totaling 36,463 tons in the January-July 2023 period, down from 48,707 tons in the corresponding period of 2022. Key importers of Philippine activated carbon included Japan, Germany, the United States, South Korea, and China. This decline in exports can be primarily attributed to diminished demand in importing countries resulting from an economic slowdown.

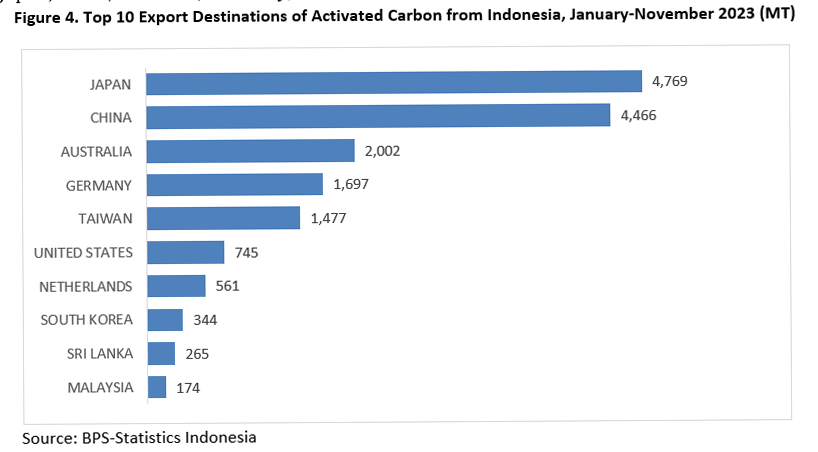

Indonesia, another notable producer of coconut shell-based activated carbon, displayed a declining trend during the January-November 2023 period, with an 8% decrease in activated carbon exports compared to the preceding year. Indonesia exported 17,093 tons of coconut shell charcoal-based activated carbon during this period, garnering export earnings of US$26.1 million. Major export destinations for the carbon from Indonesia were Japan, China, Australia, Germany, and Taiwan.

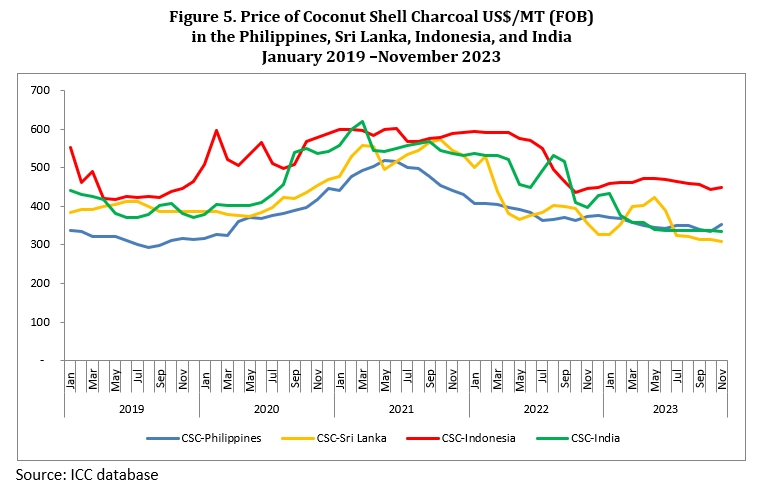

Against the backdrop of diminished demand for activated carbon, the price of coconut shell charcoal, the primary raw material for carbon production, experienced a downward trajectory across various producing nations. Over the period from January to November 2023, the price exhibited a downward trend in the Philippines, Sri Lanka, and India, while remaining relatively stable in Indonesia. Average prices for charcoal during January-November 2023 ranged from US$351/MT to US$461/MT, highlighting the diversity of this market commodity.

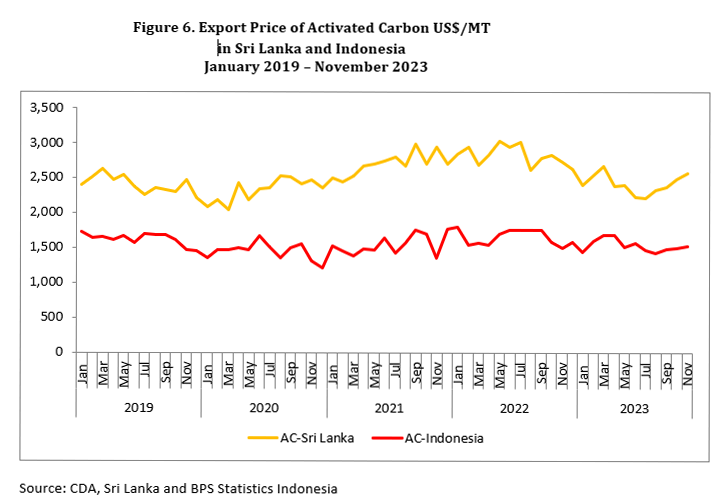

Conversely, the export price of activated carbon demonstrated fluctuating patterns in 2023. For instance, in Indonesia, the price escalated from US$1,433/MT in January 2023 to US$1,675/MT in April 2023, only to decrease to US$1,468/MT by July 2023 and gradually increase to reach US$1,527/MT in November 2023. Similarly, the price of activated carbon in Sri Lanka saw a fluctuated trend from US$2,391/MT in January 2023 to US$2,671/MT in March 2023 but then decreased to US$2,208/MT in July 2023. The price gradually went up to reach US$2,570/MT in November 2023. These price fluctuations can be attributed to a range of factors, including shifts in demand and supply, production costs, and global economic conditions.