- Home

- Statistics

- Market Review

Market Review of Coconut Oil

September 2023

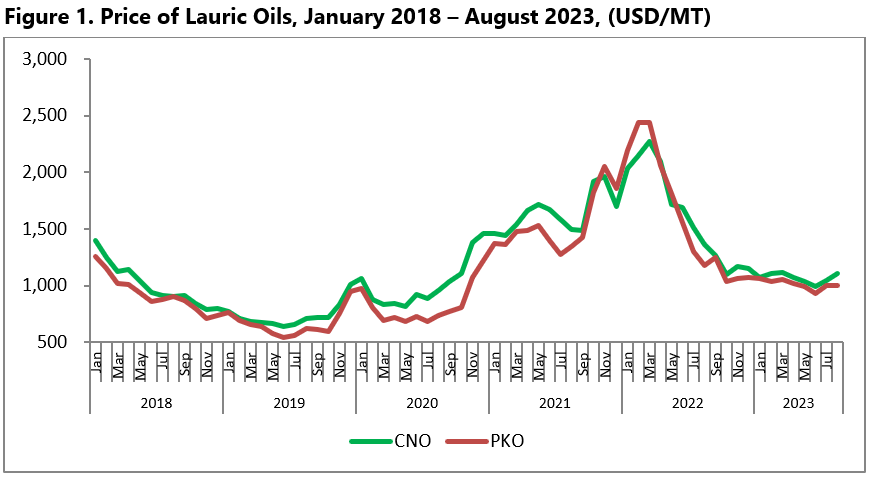

In the first half of 2023, the global lauric oils market exhibited notable price trends that shed light on the industry's dynamics. During January to August 2023, the price of coconut oil remained relatively stable. It began the year at US$1,071/MT in January 2023 and exhibited minor fluctuations, reaching US$1,102/MT in August 2023. This stability was the result of a delicate balance between supply and demand. However, with the anticipation of an upturn in demand and the possibility of decreased supply, the outlook for coconut oil prices suggests an upward trend in the coming months.

In contrast, the price of palm kernel oil experienced a gradual decline during the same period. It commenced at US$1,060/MT in January 2023 and steadily decreased to US$998/MT in August 2023, averaging at US$1,010/MT. This decrease in price can be attributed to a variety of factors, including supply dynamics and market forces. As the lauric oils market adapts to changing conditions, the price of palm kernel oil is also expected to reflect these adjustments, with an anticipation of improved prices in the upcoming months.

The first half of 2023 brought forth notable shifts in the supply dynamics of lauric oils, with the Philippines and Indonesia showcasing distinct performances.

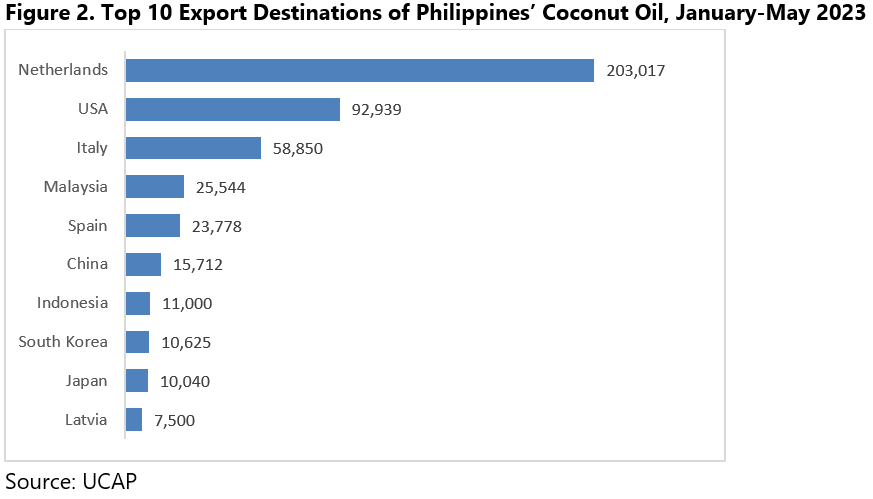

The Philippines, renowned for its role in the production and export of coconut oil, experienced a significant drop in export performance during the initial five months of 2023. According to data from the Philippine Statistics Authority, coconut oil exports from the country totaled 470,004 tons during this period, marking a substantial reduction of 15% compared to the previous year. This decline can be attributed to a combination of lower demand and higher supply. Major destinations for these exports included the Netherlands, the USA, Italy, Malaysia, Spain, and China.

In contrast to the Philippines, Indonesia witnessed a boost in coconut oil exports during the first half of 2023. The country shipped 439,119 MT of coconut oil to the global market, indicating a 9.3% increase compared to the previous year's volume. However, despite the increase in export volume, the export earnings declined from US$751.9 million to US$439.8 million, reflecting a lower unit price of the oil. Major markets for Indonesian coconut oil exports included Malaysia, the Netherlands, China, the United States, and Sri Lanka.

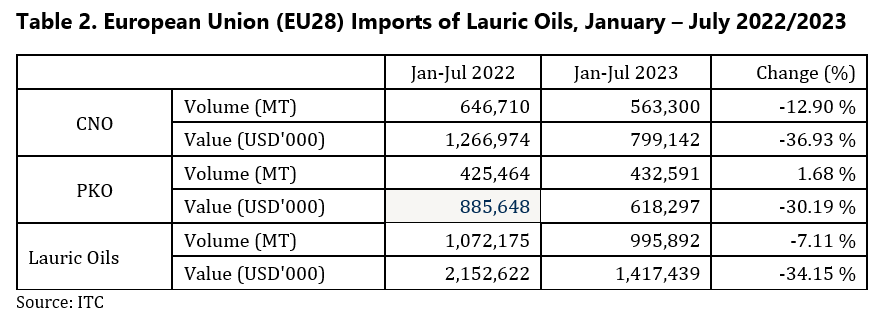

The European and US markets, two significant players in the global lauric oils trade, saw notable changes in demand during the first half of 2023. The European market experienced a considerable decline in lauric oil imports during this period. Imports of lauric oils in this region decreased by 7%, with coconut oil being the primary contributor to this decline. The economic slowdown in Europe played a pivotal role in the drop in demand for coconut oil and other lauric oils. However, there are expectations of a recovery as the regional economy shows signs of improvement.

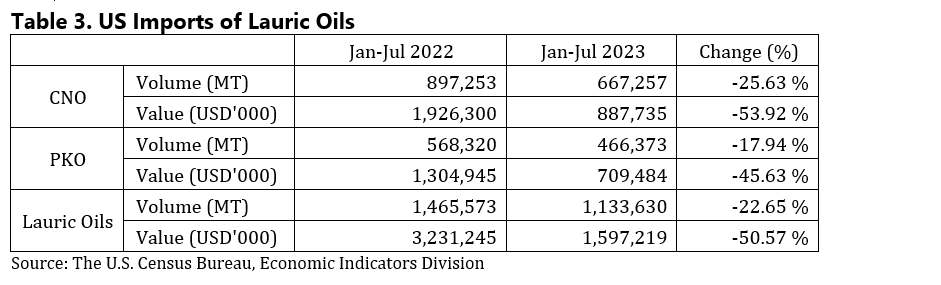

Similarly, the United States market witnessed a substantial decline in lauric oil imports during the first half of 2023. Imports of these oils plummeted by 22.7%, primarily due to a surge in coconut oil imports. US imports of coconut oil fell from 897 thousand tons in January to July 2022 to 667 thousand tons during the same period in 2023. The economic slowdown in the US played a crucial role in this reduction in imports.

It is important to note that the decline in demand for lauric oils in both the European and US markets is expected to be temporary. As the economies of these regions gradually improve, the demand for these oils is projected to recover, potentially driving growth in the lauric oil trade.

The first half of 2023 witnessed various trends in the global trade of lauric oils, with significant fluctuations in price, contrasting supply dynamics in the Philippines and Indonesia, and shifts in demand in the European and US markets. While the lauric oils market adapted to the economic slowdown in major importing regions, there is optimism for a recovery in demand as these economies improve. As supply and demand dynamics realign, it is expected that prices of lauric oils will see positive shifts in the near future, reflecting the evolving landscape of the global lauric oils trade.