- Home

- Statistics

- Market Review

Market Review of Coconut Oil

May 2023

In 2022, global imports of lauric oils witnessed a substantial reduction of 535 thousand tons or 15% compared to the previous year. European countries experienced a decline in imports demand by 7.3% throughout January to December 2022. Conversely, the US market saw a slight increase of 3% in lauric oil imports, primarily driven by a surge in coconut oil imports. During this period, US imports of coconut oil rose from 468 thousand tons to 535 thousand tons.

Table 1. European Union (EU28) Imports of Lauric Oils, January – December 2021/2022

| Jan-Dec 2021 | Jan-Dec 2022 | Change | ||

| CNO | Volume (MT) | 995,763 | 1,023,103 | 2.7% |

| Value (USD'000) | 1,625,394 | 1,966,552 | 21.0% | |

| PKO | Volume (MT) | 952,107 | 781,643 | -17.9% |

| Value (USD'000) | 1,334,089 | 1,508,549 | 13.1% | |

| Lauric Oils | Volume (MT) | 1,947,870 | 1,804,746 | -7.3% |

| Value (USD'000) | 2,959,483 | 3,475,101 | 17.4% | |

Source: ITC

However, the first quarter of 2023 revealed a decrease in global demand for coconut oil. US imports of the oil declined by 27% compared to the same period in the previous year. This shift in demand could be attributed to various factors such as changing consumer preferences, market saturation, or economic fluctuations. Monitoring this trend will be crucial to understanding the future trajectory of the coconut oil market.

Table 2. US Imports of Lauric Oils

| Jan-Dec 2021 | Jan-Dec 2022 | Change (%) | Jan-Mar 2022 | Jan-Mar 2023 | Change (%) | ||

| CNO | Volume (MT) | 468,095 | 535,057 | 14.31% | 132,931 | 96,848 | -27.14% |

| Value (USD'000) | 830,561 | 1,080,269 | 30.06% | 269,077 | 133,697 | -50.31% | |

| PKO | Volume (MT) | 381,713 | 348,096 | -8.81% | 76,878 | 89,476 | 16.39% |

| Value (USD'000) | 496,713 | 756,400 | 52.28% | 145,884 | 138,702 | -4.92% | |

| Lauric Oils | Volume (MT) | 849,808 | 883,153 | 3.92% | 209,809 | 186,324 | -11.19% |

| Value (USD'000) | 1,327,274 | 1,836,669 | 38.38% | 414,961 | 272,399 | -34.36% | |

Source: The U.S. Census Bureau, Economic Indicators Division

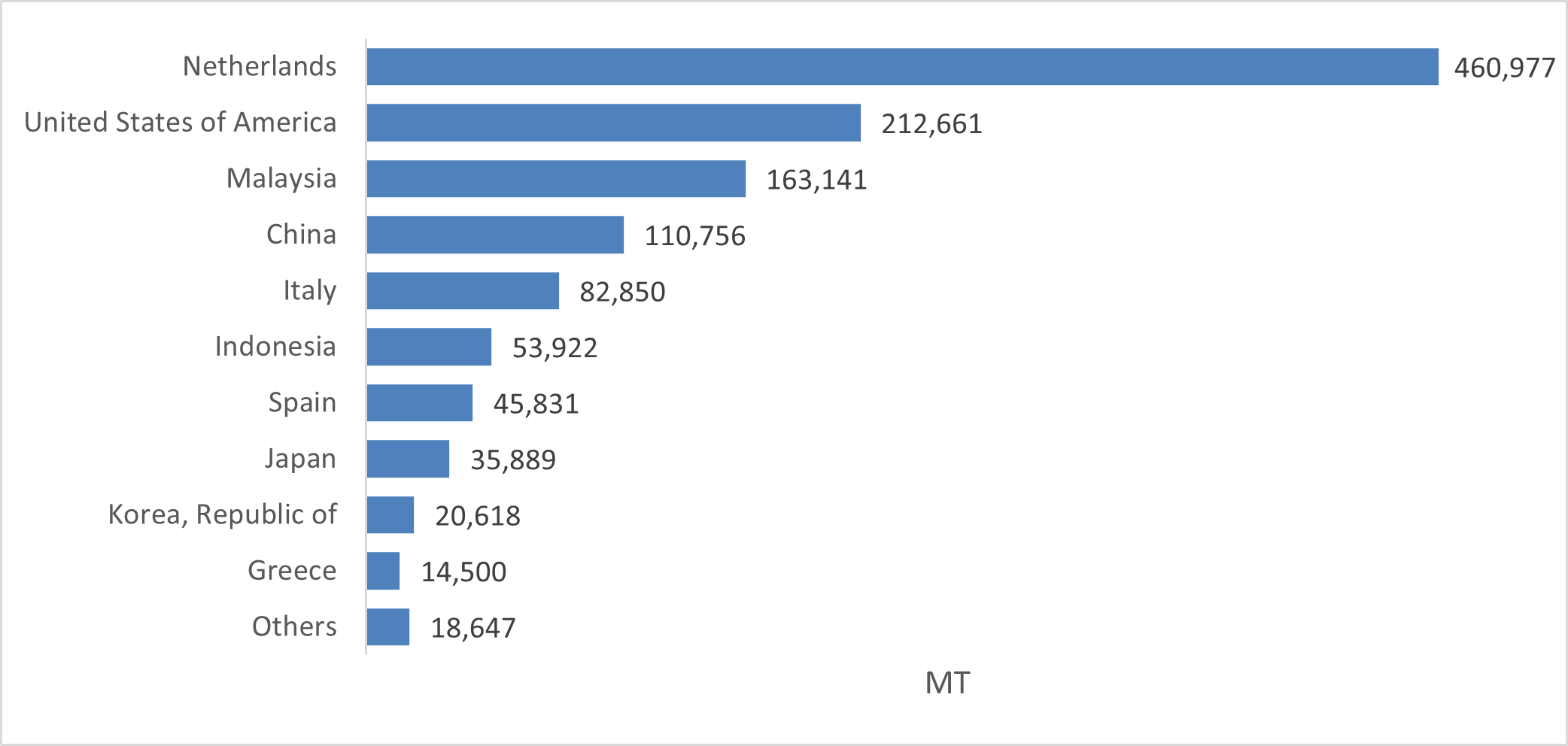

On the supply side, the Philippines demonstrated an improvement in their export performance of lauric oils. According to the Philippine Statistics Authority, coconut oil exports from the country totaled 1,219,792 tons during January to December 2022, marking a significant 38% increase compared to the previous year. Lower prices and higher supply were key drivers behind the surge in demand for Philippine coconut oil. Main destinations for these exports included European countries, the USA, Malaysia, China, and Indonesia.

Figure 1. Export Destinations of Philippines’ Coconut Oil, January-December 2022

Source: UCAP

Similarly, Indonesia experienced a boost in coconut oil exports during the same period. The country shipped 707,752 MT of coconut oil to the global market, indicating a 16% increase compared to the previous year's volume. This resulted in export earnings rising from US$959.2 million to US$1,118.4 million, representing a notable 17% increase. Major markets for Indonesian coconut oil included the United States, Malaysia, China, and the Netherlands.

Table 3. Exports of Lauric Oils from Indonesia

| Jan-Dec 2021 | Jan-Dec 2022 | Change (%) | Jan-Mar 2022 | Jan-Mar 2023 | Change (%) | ||

| CNO | Volume (MT) | 611,452 | 707,752 | 15.7% | 155,968 | 207,765 | 33.2% |

| Value (USD'000) | 959,230 | 1,118,374 | 16.6% | 300,866 | 210,545 | -30.0% | |

| PKO | Volume (MT) | 1,418,404 | 1,338,528 | -5.6% | 88,685 | 107,193 | 20.9% |

| Value (USD'000) | 1,926,114 | 2,009,000 | 4.3% | 202,738 | 121,175 | -40.2% | |

| Lauric Oils | Volume (MT) | 2,029,856 | 2,046,279 | 0.8% | 244,653 | 314,958 | 28.7% |

| Value (USD'000) | 2,885,344 | 3,127,374 | 8.4% | 503,604 | 331,720 | -34.1% | |

Source: BPS-Statistics Indonesia

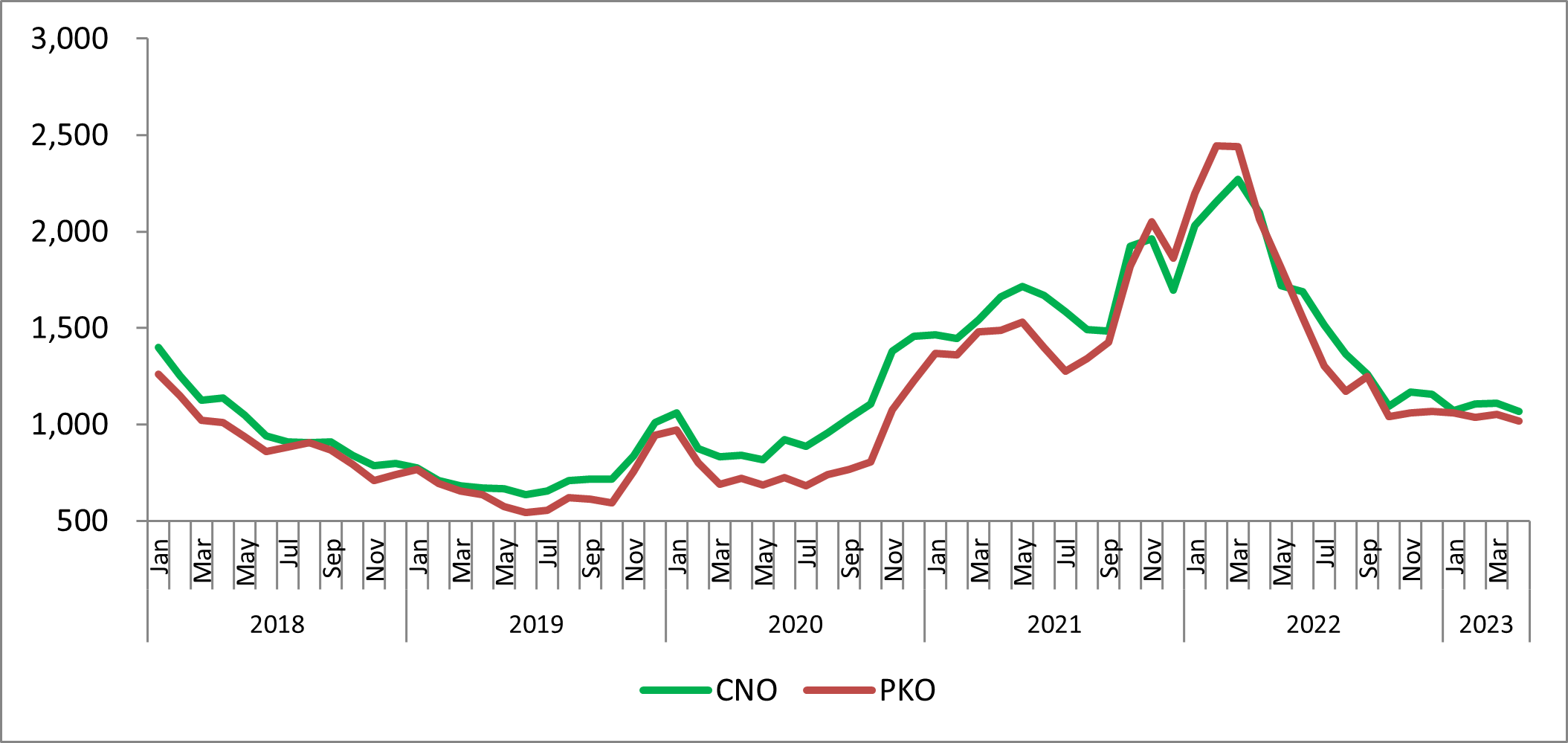

During the first quarter of 2023, the market price of lauric oils remained relatively stable. The price of coconut oil fluctuated between US$1,069/MT and US$1,111/MT. Notably, the price of coconut oil in April 2023 was only half of what it was in April 2022. Similarly, the price of palm kernel oil exhibited a similar pattern, averaging at US$1,041/MT from January to April 2023. It is anticipated that these prices will improve in the upcoming months due to the expected decrease in oil supply.

Figure 2. Price of Lauric Oils, January 2018 – April 2023, (USD/MT)

The global trade of lauric oils experienced a significant decline in imports in 2022. However, the industry witnessed varying demand trends in the first quarter of 2023, with the US market experiencing a substantial decrease in coconut oil imports. On the supply side, both the Philippines and Indonesia showcased improved export volumes and earnings. Market prices of lauric oils remained relatively stable during the first quarter of 2023, but the anticipation of a decrease in oil supply suggests a potential increase in prices in the near future. As the industry continues to evolve, closely monitoring market dynamics will be crucial for stakeholders to make informed decisions and adapt to changing trends.