- Home

- Statistics

- Market Review

Market Review of Coconut Oil

May 2022

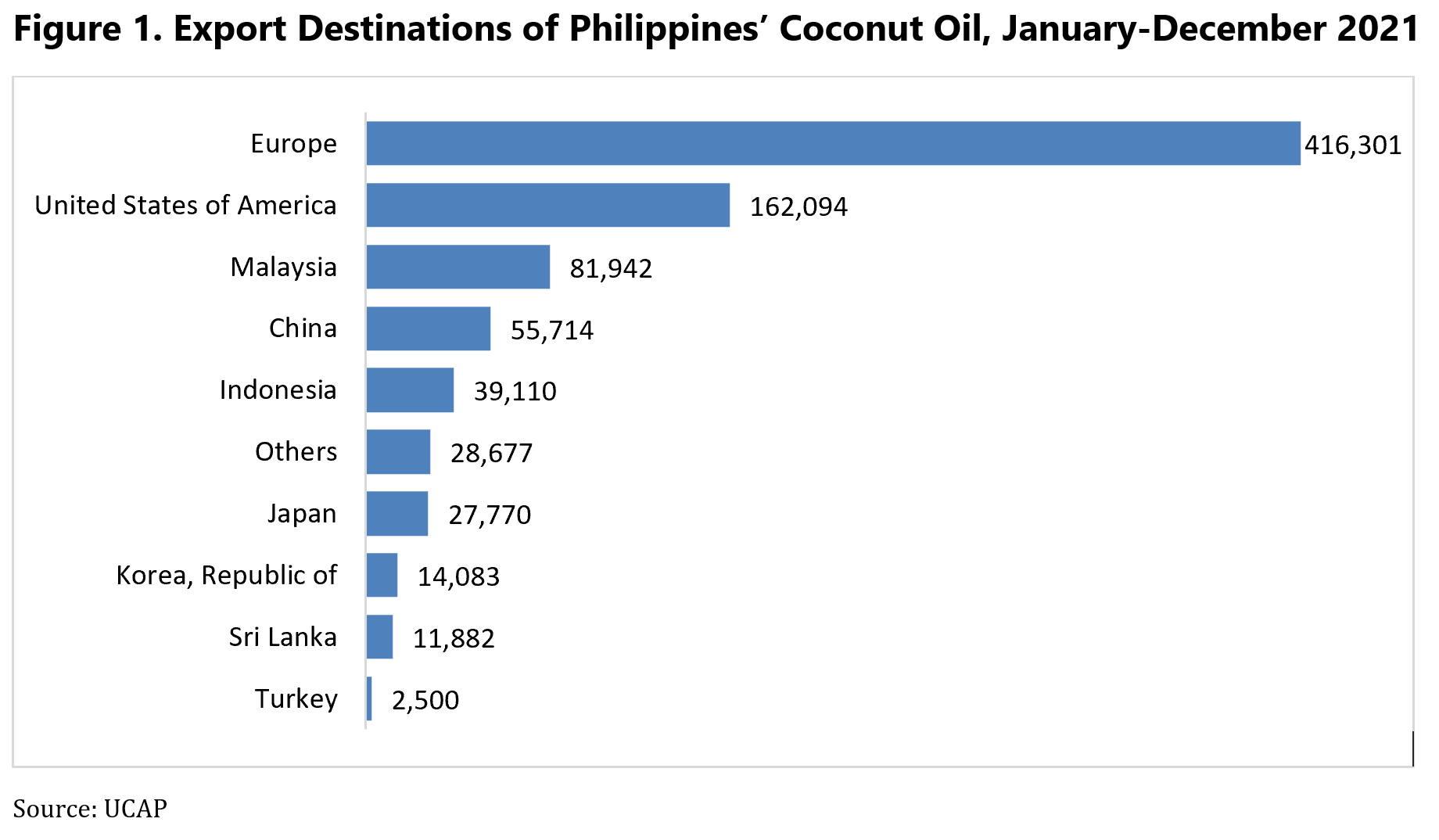

Global trade of coconut oil during the year 2021 faced some challenges especially delays and higher costs of shipments. Amid the challenges facing by industries, Philippines unexpectedly managed to improve their export of the products. Philippine Statistics Authority reported that during the period of January-December 2021, coconut oil exports from Philippines went up to 881,086 metric tons from 840,073 metric tons in January-December 2020. Demand from European countries and USA, the traditional market for coconut oil from Philippines, increased during the period. Export of the oil to European countries went up from 388,317 in 2020 tons to 396,813 tons in 2021. At the same time, export to US market hiked from 152,004 tons to 157,408 tons.

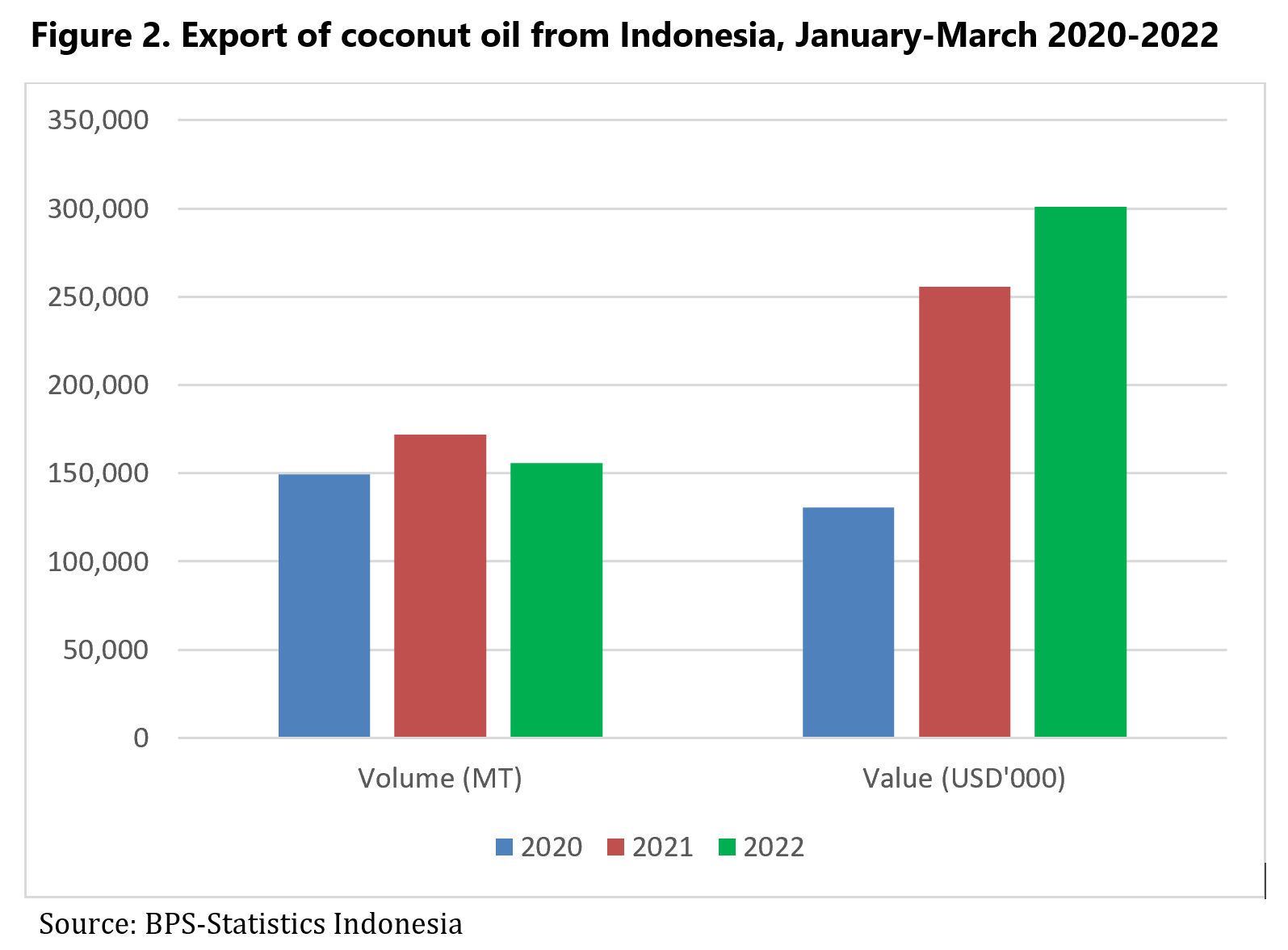

At the same time, Indonesia recorded a higher export volume of coconut oil during 2021. During the period January-December 2021, Indonesia shipped 611,448 MT coconut oil to global market. The export was 9.8% higher as opposed to the previous year’s volume. Major markets for Indonesian coconut oil were United States, Malaysia, China, and Netherlands. Export volume to these four countries constituted for more than 70% of the total export. During first quarter of 2022, export of the oil from Indonesia was lessening from 171,886 tons to 155,968 tons. However, in terms of value the export was increasing US$255.5 million to US$300.9 million reflecting higher price of the oil.

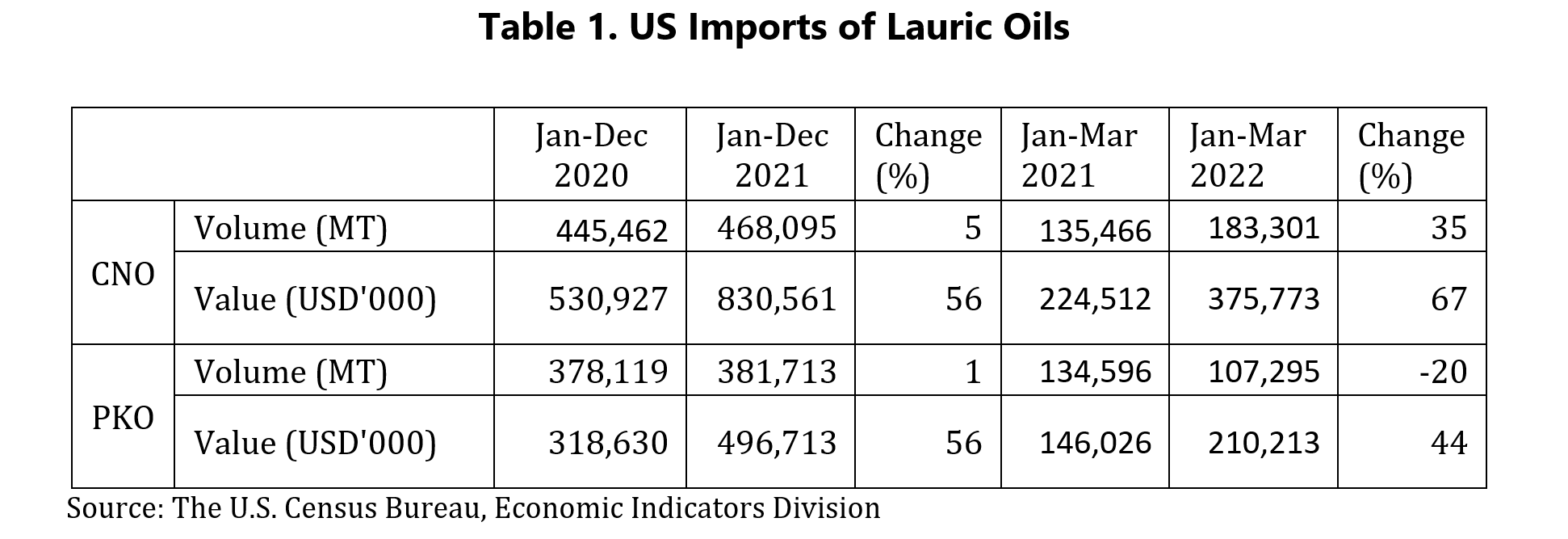

As the global economic is recovering, demand of lauric oils started to improve during 2021. During January-December 2021, US import of coconut oil was recorded a significant upsurge to level of 468,095 MT meaning an increase of 5% compared to the volume a year earlier. At the same time, import of palm kernel oil slightly leveled up 378,119 MT in 2020 to 381,713 MT during January-December 2021. Hence, total imports of lauric oils by US market hiked to 849,808 tons which was 3.2% higher than the previous year’s volume. Furthermore, imports of Lauric oils keep increasing in 2022. During January-April 2022 US imports of the oils increased by 8% from 270,062 MT to 290,597 MT.

As the global economic is recovering, demand of lauric oils started to improve during 2021. During January-December 2021, US import of coconut oil was recorded a significant upsurge to level of 468,095 MT meaning an increase of 5% compared to the volume a year earlier. At the same time, import of palm kernel oil slightly leveled up 378,119 MT in 2020 to 381,713 MT during January-December 2021. Hence, total imports of lauric oils by US market hiked to 849,808 tons which was 3.2% higher than the previous year’s volume. Furthermore, imports of Lauric oils keep increasing in 2022. During January-April 2022 US imports of the oils increased by 8% from 270,062 MT to 290,597 MT.

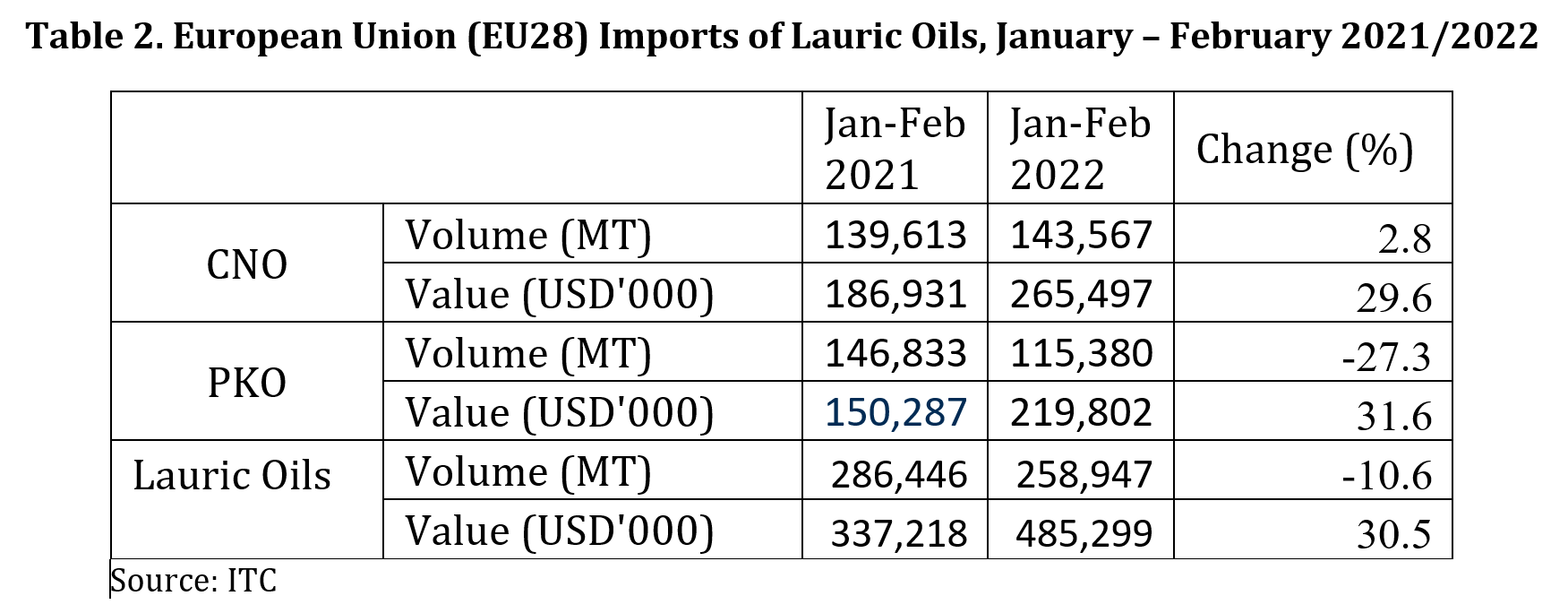

Meanwhile, shipments of the oils to European market in the beginning of 2022 showed decreasing trend attributed to the lower imports of palm kernel oil. During period of January-February 2022, imports of lauric oils by European countries was 258,947 which was 10.6% lower than the volume a year earlier. Import of palm kernel oil contributed to the lower import of the oils. Import volume of the oil dropped by 27.3% during the period. Meanwhile, coconut oil import by European countries rose by 2.8% during the period of January-February 2022. Moreover, demand of lauric oil is expected to hardly recovering in 2022 in European market following political and economic uncertainty in the region.

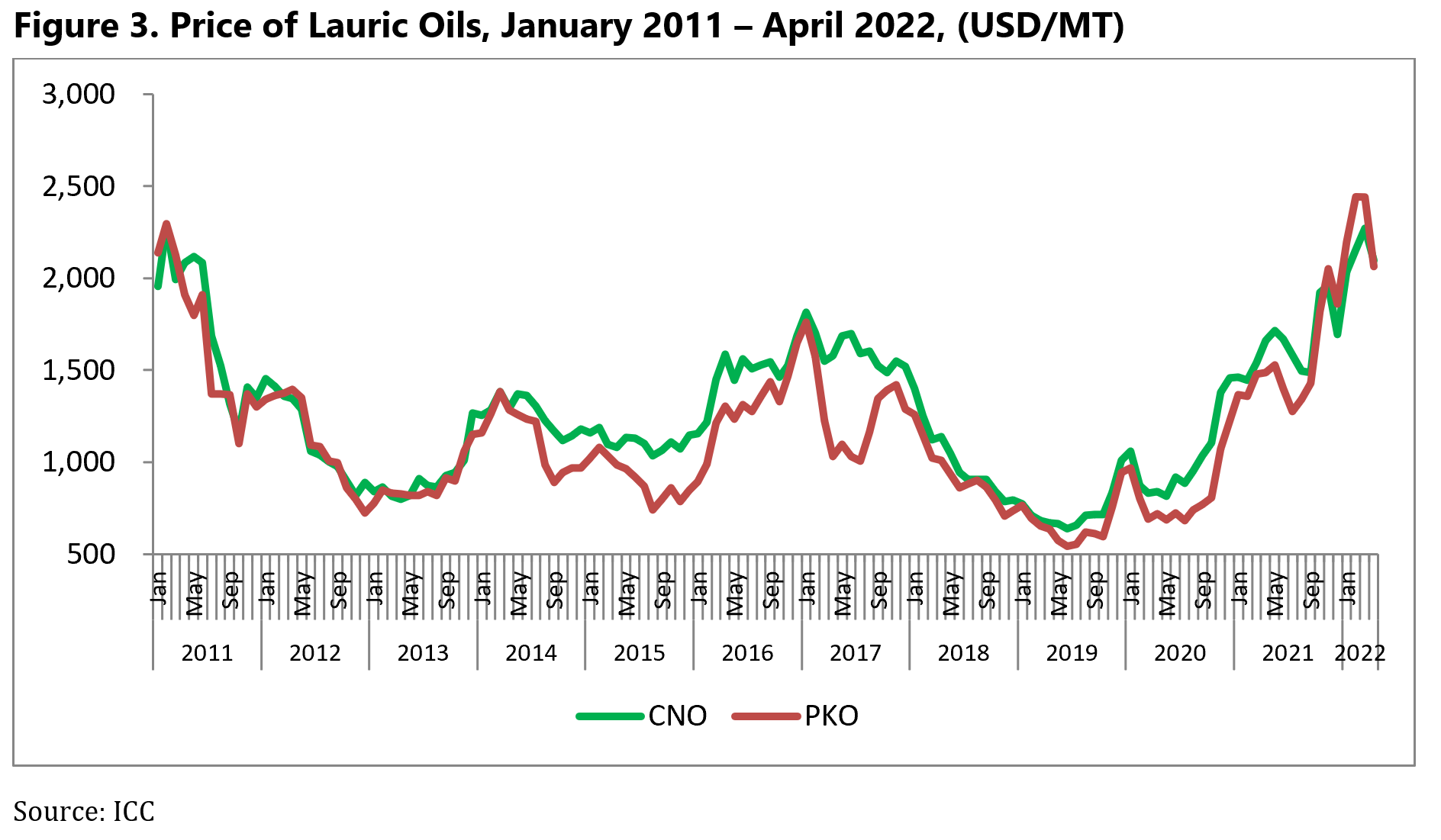

Higher prices of lauric oils were prevailed in the first quarter of 2022. Price of coconut oil appreciated by 34% and price of palm kernel oil jumped by 31% during the January-March 2022. Global shock in vegetable oils supply pushed prices of the oils to a higher level. However, a sharp setback of prices had been seen in the last month. Price of palm kernel oil cut by 15% and price of coconut oil depreciated by 8% from March to April 2022. The lower prices is expected to revive demand of the oils.